Prerequisites:

- To be a SecuTix-Ogone customer. For more information, you can create a Services ticket → Ticketing → Setting up a payment online.

- Make sure your merchant contract allows you to process Recurrent type transactions from eCommerce (and MOTO for processing via box office). This information can be obtained directly from your acquirer (usually your bank).

Note: Even though they are automatic, these processes do not exempt you from monitoring to ensure that the installments are actually paid, and to take the necessary measures in case they are not paid (order cancellation, etc).

ATTENTION - LEGAL INFORMATION

The legal framework regulates payments in several installments. Payments cannot be received more than 3 months after the date of the benefit of a product, otherwise, they will be considered as credit operations.

Thus, apart from subscription-type products, it is legally not possible to offer payment with more than 3x with no fees.

For subscription-type products without automatic renewal, the general rule is to make sure that the last installment occurs before the end of the last event consumed within this subscription.

The implementation of this function does not exempt you from inquiring about the applicable legal framework.

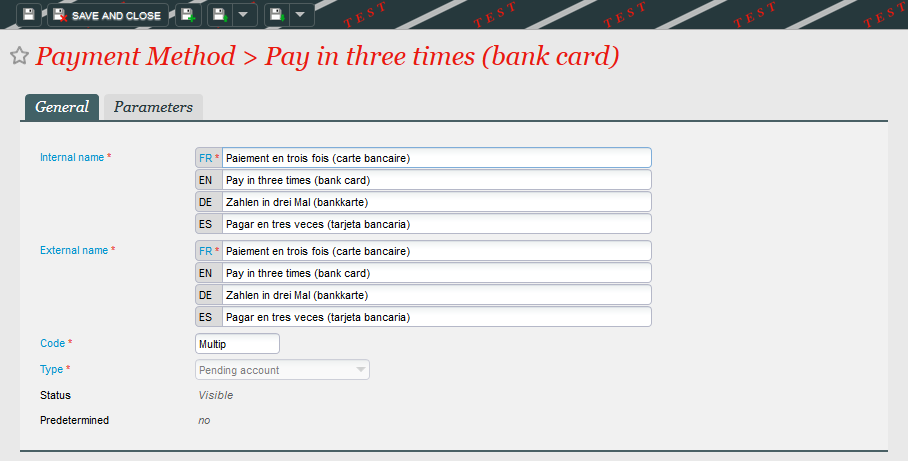

1) Create a Pending account payment type

Give it a name (explicitly).

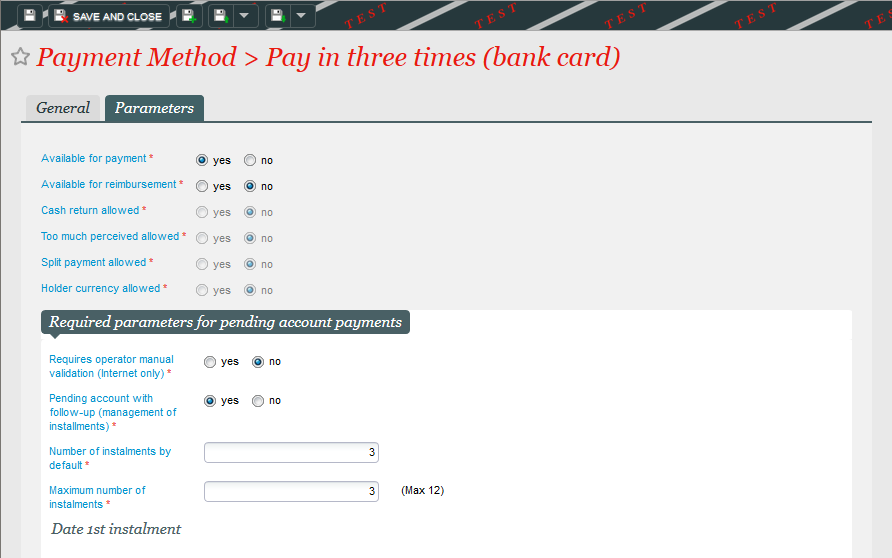

At the level of the parameters, make it available only for the payment, and activate the option Pending account with follow-up (management of installments).

Enter the number of expected installments (enter an identical value in the default number and the maximum number in order to always have the same number of installments).

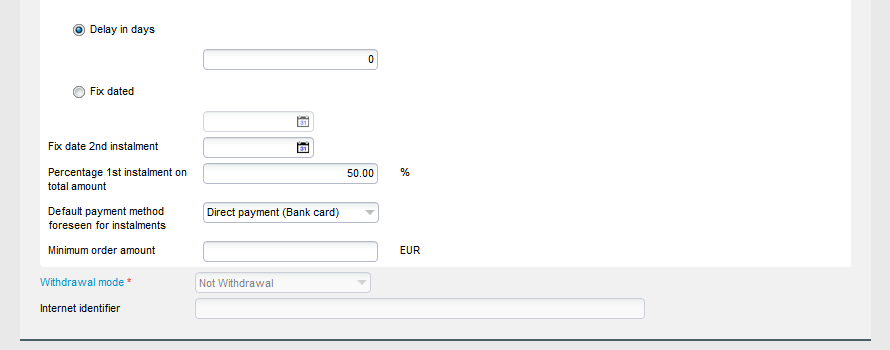

The date of the first installment can be dynamic (delays in days, 0 indicating that the first due date takes place when ordering) or static (fix dated, it is necessary then to enter the desired date - If the fixed date is in the future at the time of purchase, the first installment will take place on this date. If the date fixed is in the past, the first installment will take place on the anniversary date of the next month. Ex: date fixed on the 15.09.2017. Any purchase made before this date will result in a first installment on 15.09. A purchase made on 23.10. will result in a first installment of the 15.11).

Please note that in case of a first installment that is not in immediate debit, customers will not be called to immediately enter their credit card number, so there will be no saving of the alias and in the date of the first installment, these customers will not be debited directly but invited to pay their installment online from their personal space.

It is possible to enter a fixed date for the second installment.

"Percentage 1st installment on total amount" allows you to determine the amount of the first installment as a percentage of the total amount. In the example, half the order will be paid at the moment of the purchase, and the remaining installments will be calculated with the remaining amount to be paid/number of installments, i.e. 50% /2. If left blank, the installments will all be equal.

The default payment method foreseen for the installments must be Direct debit (Credit Card).

The Minimum order amount allows you to indicate from which basket amount the payment in installments will be available. It is thus possible for you to offer payment in several installments only after a certain threshold, 300€ for example.

Save and Close.

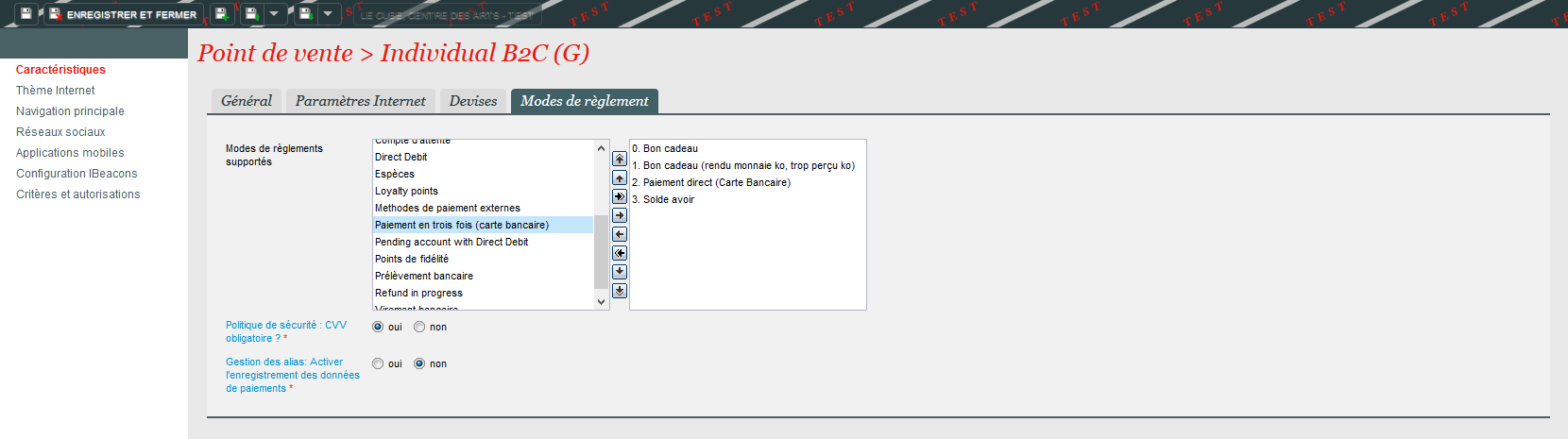

Associate the newly created method to the corresponding internet point of sales (Organization → Initialization → Sales channels).

2) Check that the pending account is active for all new customers

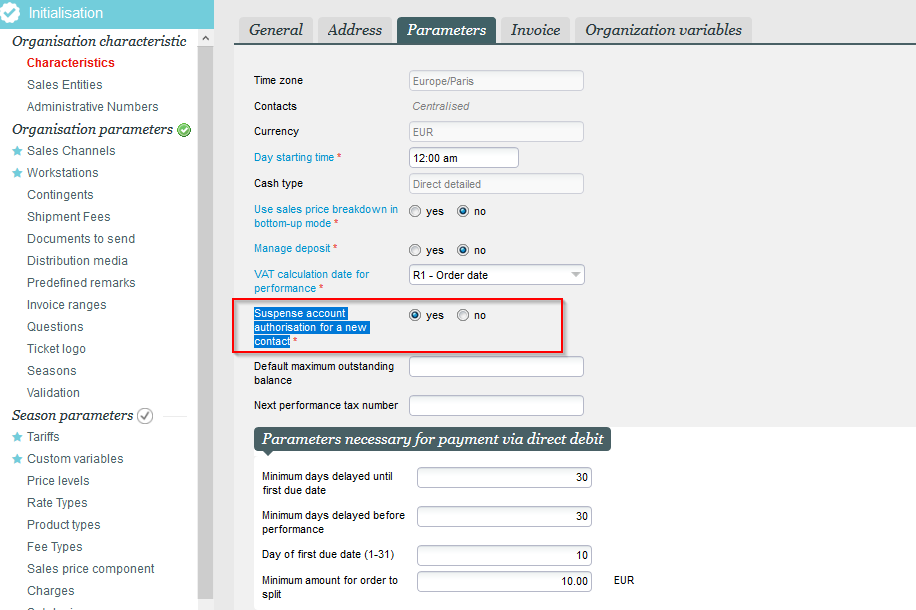

This can be done in Organization → Initialization → Characteristics → Parameters.

Note: if the value is set to No, change it to Yes and contact the support team to authorize it for all existing contacts.

WARNING: if you have authorized another payment method of Pending account in the same sales channel as the payment in several installments, this first method will become available to all your customers after this step.

3) Decide if the last installment must take place before the first dated product in the basket.

By default, the above rule is applied: it is not possible to use the payment in 3x if the event on the basket is in 2 months.

If you wish to remove this rule, please contact us asking us to change the Waiting Account With Installment Payment parameter in the institution's parameters.

4) Activate email documents to be sent automatically

Institution → Initialization → Document types → New

These are the documents:

- Instalment payment failure email

- Instalment reminder email

- Instalment payment success email

5) Configure the batch

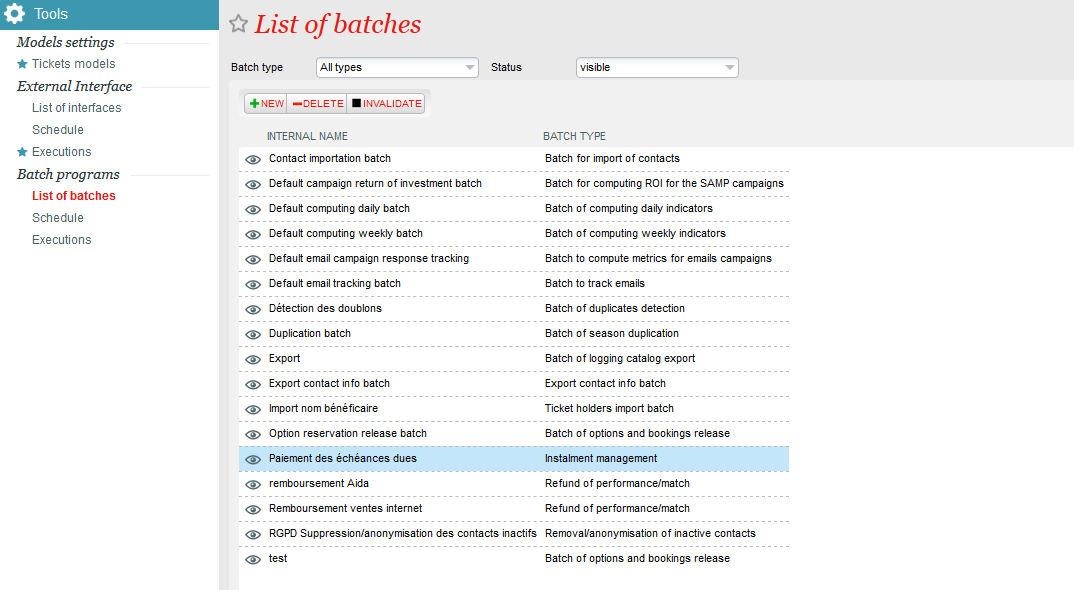

Organization → Tools → List of batches

Activate the Instalment management batch

This batch contains two programmations:

- Pay due instalments: process of payment of the installment.

- Send due payment reminder: sending an email notification to the contact who has an installment to be paid.

a) Pay due installments:

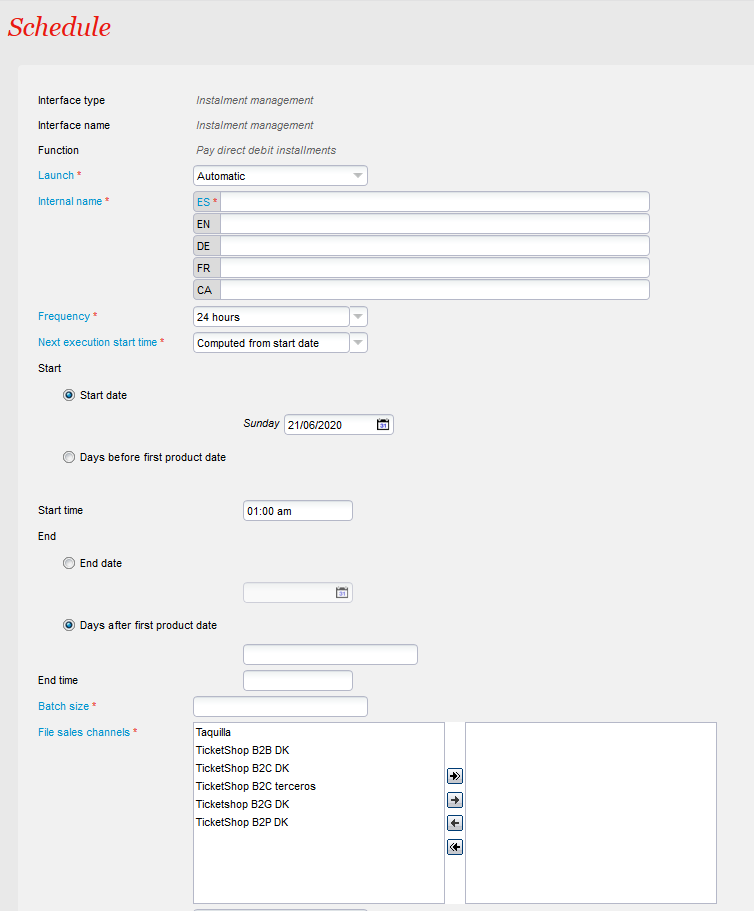

Determine the start mode: manual or automatic (recommended).

If automatic, the frequency must be indicated as well as the time and start date. It is recommended to run the batch every 24 hours, starting at 1:00 a.m.

The batch size represents the number of files the batch will process. It is completely possible to set a high value so it processes all the files.

The sales channel must be the one(s) in which the sale with the installment payment was made. It is possible to add several channels.

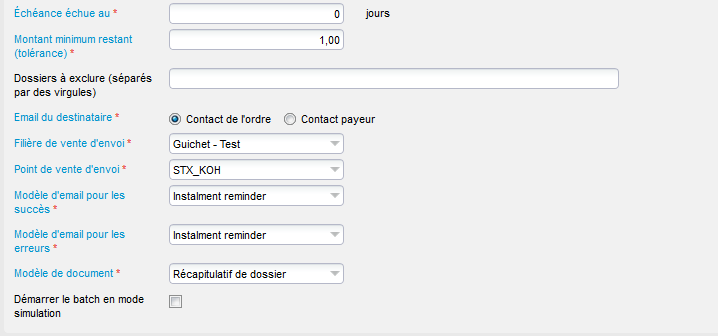

Instalment overdue by: here, we must consider that 0 is the current date. This is the recommended value. Thus, the batch will process all the due installments the day of the batch processing. If the schedule is done so that the batch runs every day, it will take all the expected installments.

A positive number x will allow all installments exceeded by x days to be processed.

A negative number x will process installments before their deadline (for example, "-3" will process all the due installments up to 3 days away).

The minimum remaining amount allows you to add a rule on the process. By default, 1.00 is the recommended value.

It is possible to enter file numbers separated by commas to exclude certain files from the batch processing.

The recipient's email allows to differentiate the order contact from the payment contact (in case they are different) so that the correct contact is notified on the due date.

Sending sales channel and distribution point of sale are used to determine which channel and point of sales the processing of the installment will be attached to.

Finally, all that remains is to associate the documents created in step 4.

Note: it is possible to start the batch in simulation mode by checking the box. If this box remains checked, the batch will run to detect which files are to be processed and will display the total, without processing them. We have to be careful then to not to check this box so that the payments can be done.

b) Send due instalment reminders

The setting of this function is very similar to the previous one.

The principle is to send an email to the contact a few days before the payment of its due date.

You will therefore need to put a positive value in the "Instalment overdue by" field.

It is not necessary to activate this function to operate the payment in several installments.

Treatment at the Box officce.

a) Prerequisites

First of all, ake sure your merchant contract allows you to process MOTO-type transactions. This information can be obtained directly from your acquirer (usally your bank).

To be able to offer the installment payments at the box office, and in addition actions described above, it is necessary to define the MOTO (Mail Order Telephone Order) payment system for the concerned channel.

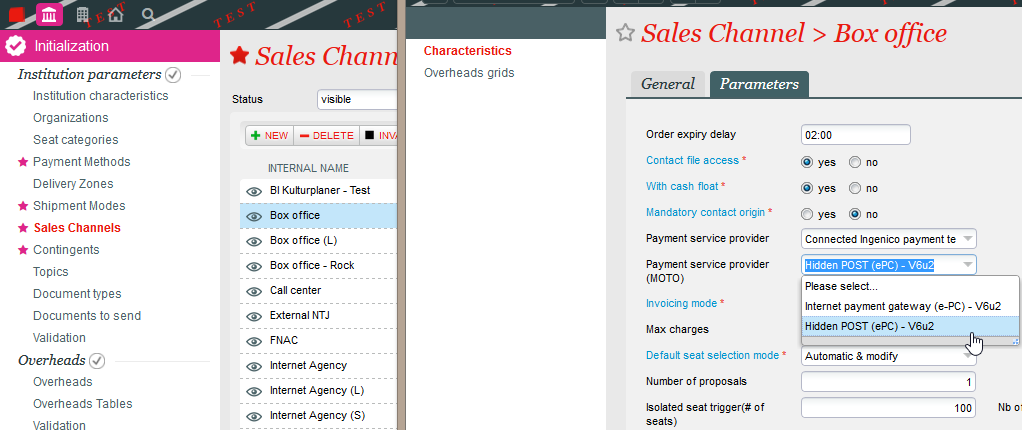

For this purpose, in Institution → Initialization → Sales channel, select the concerned channel. In the setting, on the Payment service provider (MOTO) line, select Hidden Post (ePC) - V6u2

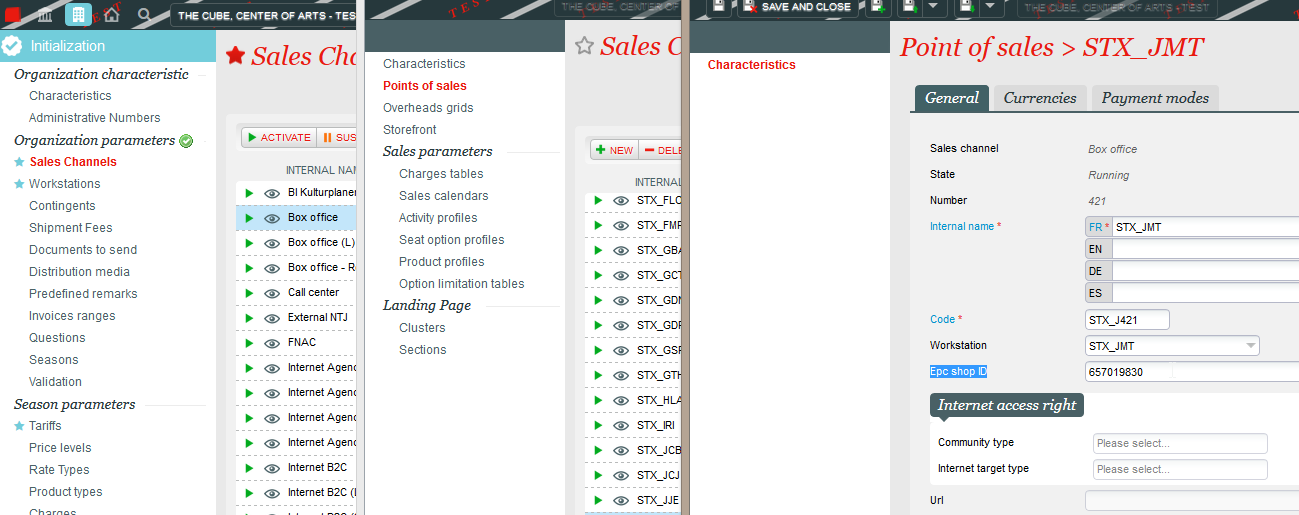

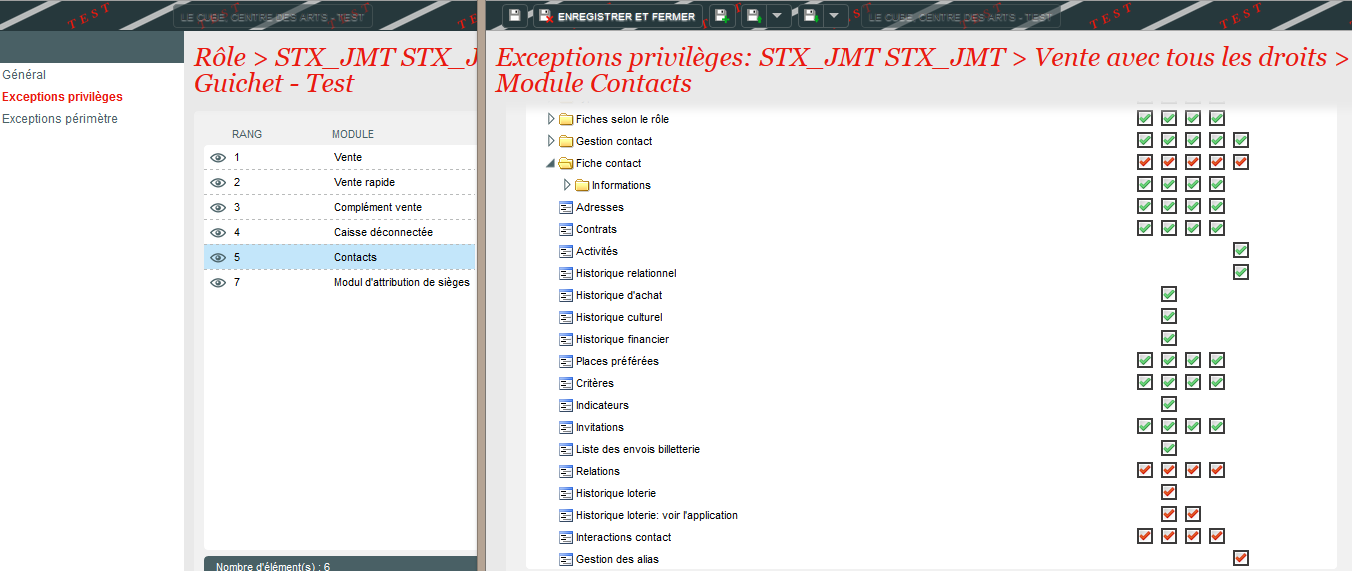

Now in Organization → Initialization → Sales channels, select the concerned channel and open the point of sale of operators authorized to use the payment in several installments. Note: if several operators are impacted, this action must be repeated for each of them.

In the Epc shop ID field, enter the same electronic payment number as the one used for online sales - this electronic payment number can be found by opening the point of sale in the internet channel, in internet settings).

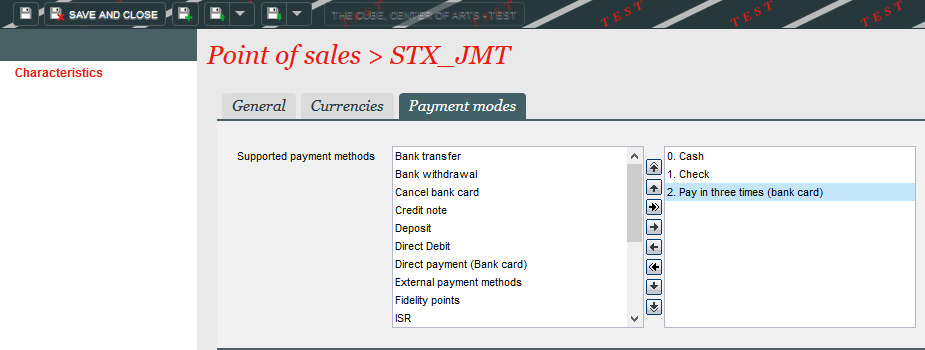

Check in the payment methods that the payment method dedicated to payment in several installments is available to the operator.

The operator is now ready to make orders via payment in installments.

b) Sales processing

The sales are processed in two steps: placing the order and paying the first installment.

1) Place the order

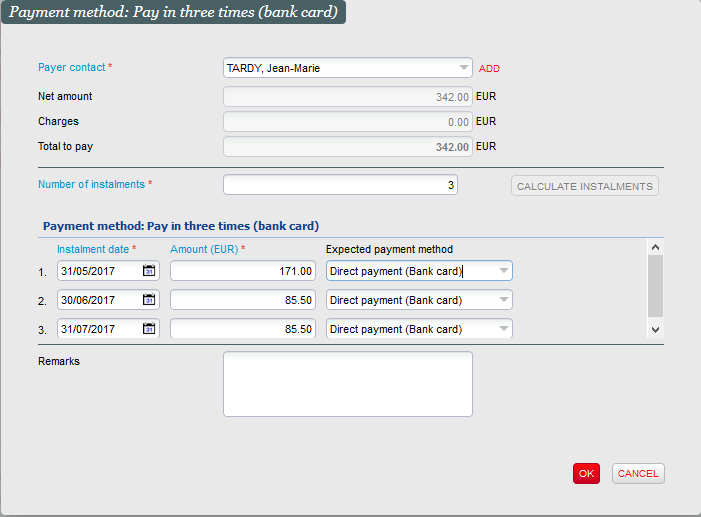

In the box office, process the order normally. Proceed to payment by choosing the mode dedicated to payment in several installments.

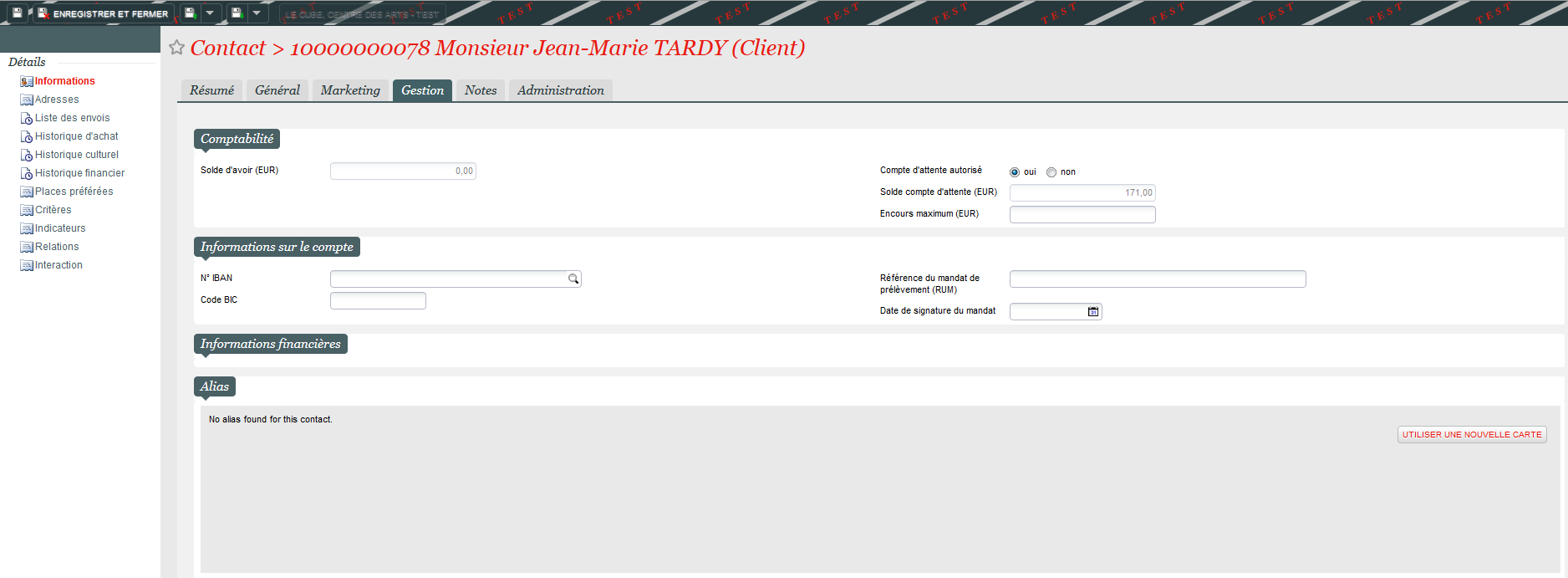

Reminder: the customer must be authorized to pay by pending account (cf: 2). If it is not the case, it is possible to change this value by accessing its contact file, and checking Yes on the Authorized pending account line of the Management tab.

At this step, the various installments are recalled, with their respective amounts. It is possible to modify the dates, amounts and expected payment methods (not recommended).

Once the Ok button is pressed, the order is closed and the tickets can be printed.

2) Pay the first installment

Note: at this step, the first installment can perfectly be paid online by the customer, directly from his account.

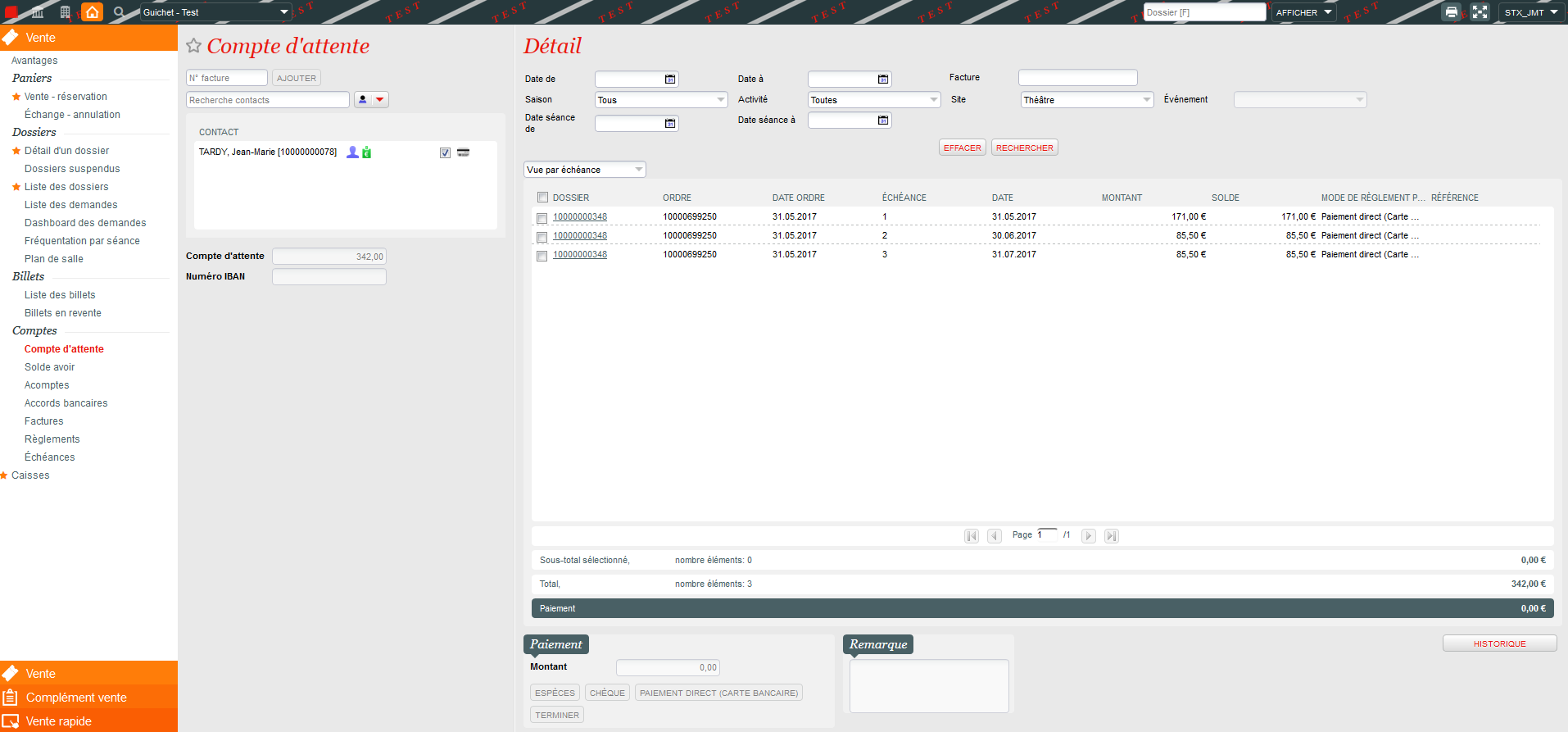

To proceed with the payment of the first installment, go to the Pending account menu in Sales context, and display the concerned contact. The different payment terms should be displayed (if necessary, choose the view by installments in the drop-down menu). )

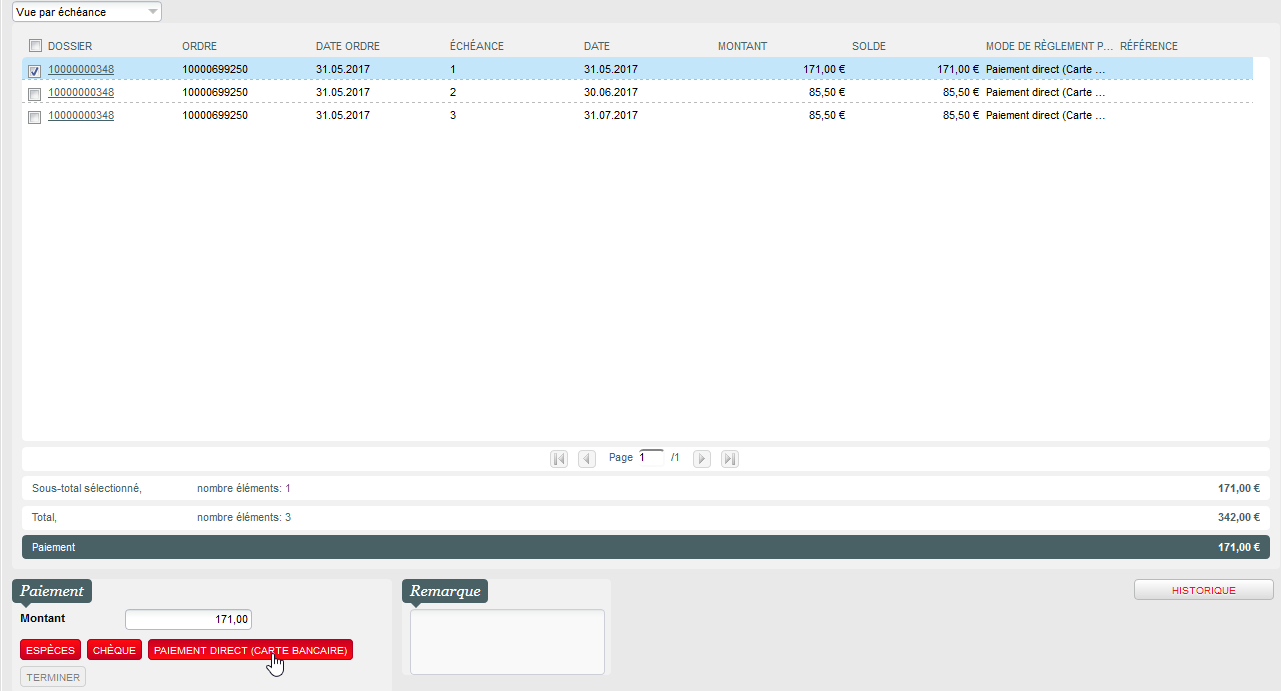

Select the first due date, and click on the expected payment method (bak card type).

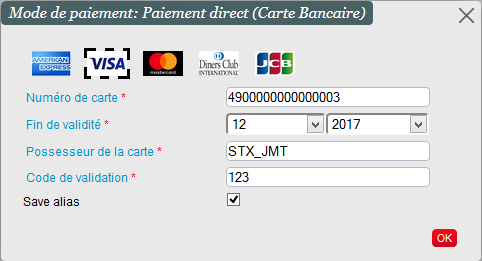

After clicking OK in the summary pop-up, the card data entry window, enter the card information, and MUST check that the Save alias box is checked  .

.

Click OK and check the result of the payment.

The following installments will be processed normally by the batch configured above (step 5).

if the operator forgets to check this box, the alias will not be saved and subsequent installments cannot be processed automatically.

However, it is possible to enter the card alias after making the payment:

- From the sales screens: enter the name of the contact and click on the logo on the right. The Use a new card button allows you to enter a bank card to save it.

- From the Contact module: find the contact concerned. In Management, the Use a new card button always allows you to make an entry.

- Case of refund: if it is necessary to cancel a sale made with payment in several installments, the file must first be canceled by choosing a refund method of the Pending account type so that the various installments are canceled. If an actual payment has already been made, the refund of the corresponding sum will be made on the costumer's credit balance.

Multiple aliases, which card is used

The current rule is that Secutix will get the list of all alias available and not expired for the customer and choose the first one on the list. The list is not ordered. So, the card used will be the same until :

- a new card is added by the customer

- or a card expire and is no more returned in the list of alias

So, if the customer has several cards on his account :

- there is no criteria that determine which card is used

- the same card will be used until the available list of card changed

there is no link with the alias created during the first payment.