It is possible to reimburse an order via the reimbursement method "Bank transfer".

For each repayment, the operator enters the customer's IBAN data. You can then generate a bank transfer file to send to your bank to make the transfers.

The steps of a wire transfer :

- Step 0: Set up the data required to manage bank transfers

- Step 1: Determine the contents of the bank transfer order (a user in the back office)

- Step 2: Generate, check and transmit the bank file

Set up

There is a standard credit transfer file corresponding to the SEPA standard. This file can be activated on request from SecuTix support (by setting the institution parameter BANK_FILE_GENERATOR and other related bank information defined at organization administrative parameters).

A method of payment of the type Bank transfer and available for reimbursement must be created and associated with the points of sale that need it.

In the administrative numbers of the organisation, the IBAN, the BIC number and the SEPA Creditor Identifier must be entered.

Entering orders

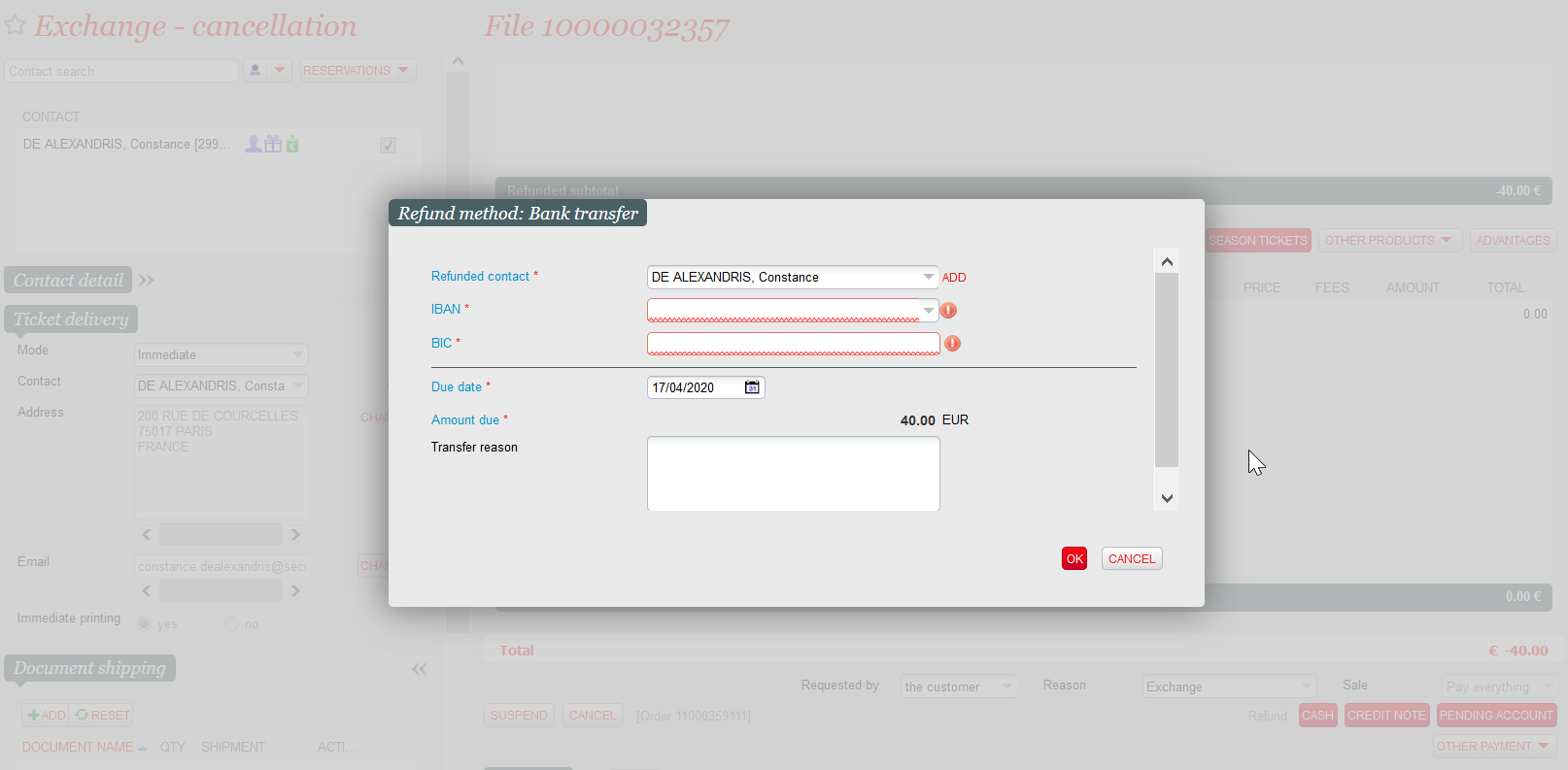

If you reimburse an order using the Bank Transfer mode, a window appears in which you must enter the following mandatory values :

- Refunded contact: by default, this is the paying contact for the order.

- IBAN and BIC: provided by the contact

- Date of transfer: by default, D+30

Generating the Bank file

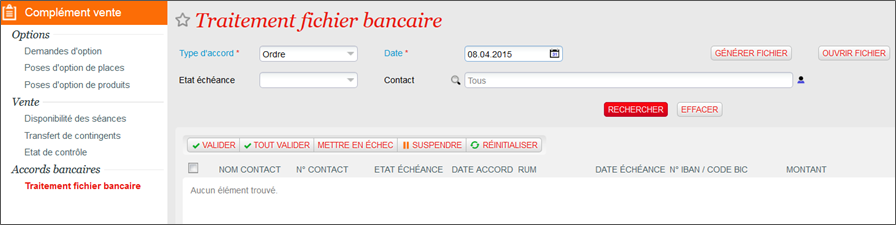

Your organisation is responsible for generating the bank files of the transfers and transmitting them to the bank in a timely manner. This is done from the Sales Add-On module by entering the following criteria :

- Type of agreement: transfer

- Date of processing by the bank (i.e. the date of the transfer)

This file contains the necessary information (amount, IBAN account, etc.) for the bank of all transfers to be transmitted whose date is less than or equal to the "Processing date" criterion entered.

Once the file has been generated, all the transfers taken into account in the generated bank file will go to the "Transmitted" status.

We recommend that you first generate (in PP) a sample file for validation with your bank before activation in Production.

To manage the content of a bank file, you can edit a report with the same two criteria "Agreement type" and "Processing date". A third criterion allows you to indicate whether this report is edited before or after the generation of the bank file.