1 - Configure Disputes/Chargeback email notification

A dispute occurs when a cardholder disputes a payment and contacts their issuer to initiate a chargeback.

This is a forced refund initiated by a customer’s bank on their behalf. In some cases, a bank will do this unprompted (if it notices fraud or there’s been an error in the process) but usually it’s initiated by the customer.

There are several reasons a customer might want to initiate a chargeback:

- Their card’s been stolen and someone’s using it fraudulently

- They’ve been refused a refund

- They made an accidental purchase or don’t remember making it

- They don’t recognize the trading name used on a billing statement

- They’re trying get free stuff

When a dispute is raised by the issuing bank, S-Pay will communicate this to you, and the dispute cycle starts.

To receive CC notifications, it is important to enable email notifications.

Open essential message subscription screen : https://essentials-live.adyen.com/essentials/system-messages

This can also be done in Essentials > System Messages > click Subscribe

Select all the information using the toggle button:

And apply the changes:

From now on you will receive email notifications.

2 - Disputes/Chargeback management

A chargeback or dispute takes place when a customer disputes a payment and asks their issuing bank to reverse it.

To charge back the payment, the bank submits a formal dispute on behalf of the customer. Then, we process the chargeback and debit the payment amount and the processing fee from your account.

A dispute goes through a number of stages after it is raised by a shopper.

IMPORTANT

As there is a time limit to defend an Dispute/Chargeback, it is very important for S-Pay customers to be attentive to disputes in order to deal with them as quickly as possible.

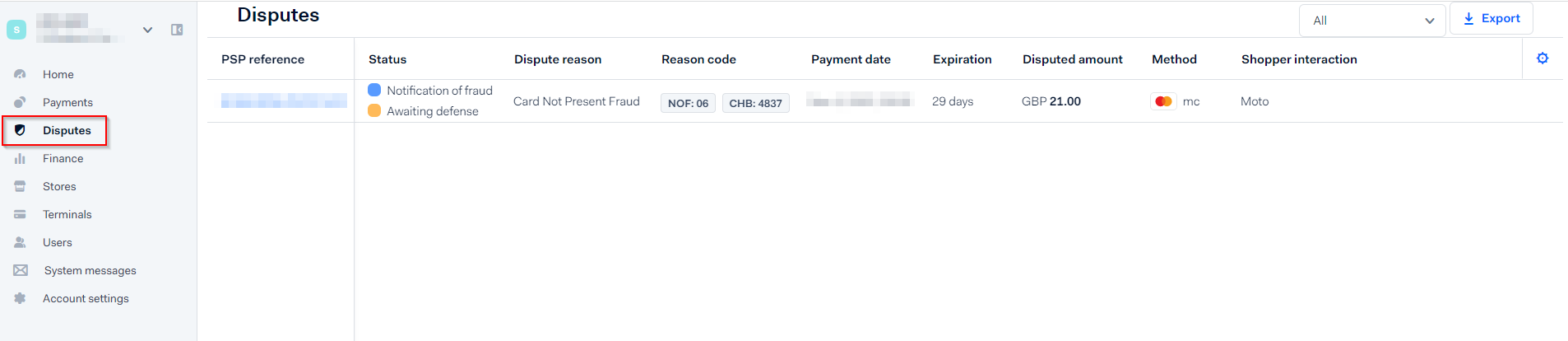

You can monitor them from the Disputes section of your Essential Customer Area or search for the disputes when you receives an email notification.

You can accept or challenge the chargeback, once the dispute flow is started. If you challenge the chargeback, you'll be asked to provide documents to support your defense.

After reviewing your documents and the shopper’s claim, the issuing bank will accept or decline your defense. If the issuer accepts your defense, the funds will return to your account.

Step 1 - Access the Dispute

In the dispute details there is two rows:

- (1) The notification of fraud (Just for information)

- (2) The Awaiting defense (Where you can challenge the chargeback)

Step 2 - Make your choice

You have to open the "Awaiting defense" to access the two possible options:

- Accept dispute (The process stops)

- Handle dispute

Step 3 - Handle the dispute

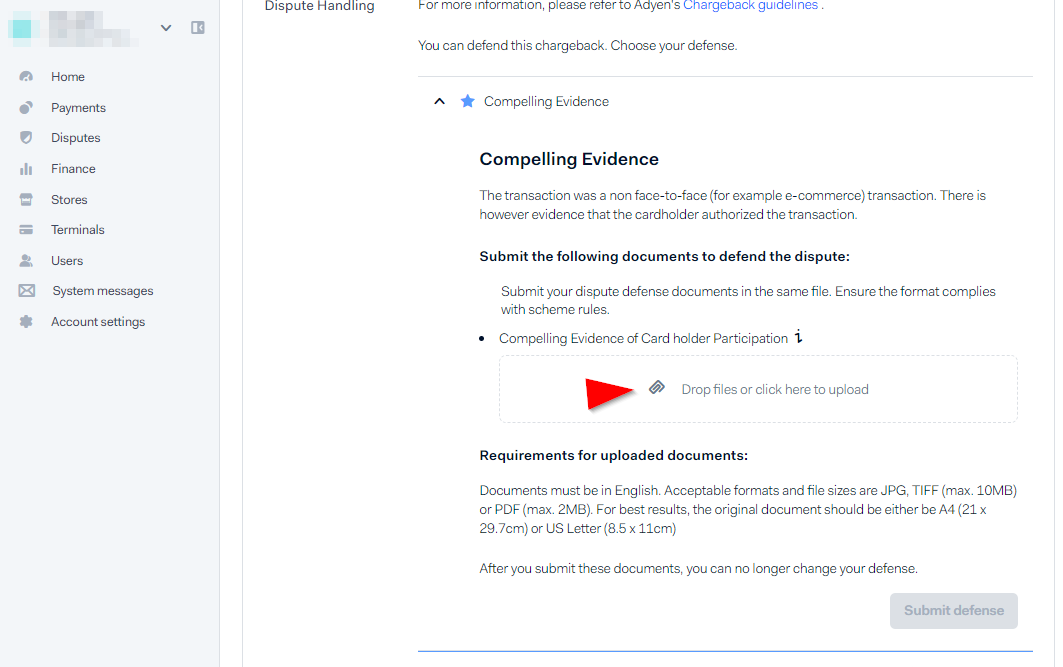

When you decide to handle the dispute, you should demonstrate that the cardholder did legitimately purchase the service or merchandise and you must provide:

Merchandise:

- Copy of invoice.

- Email conversation with cardholder.

- DHL-signed proof of delivery, and AVS match.

- Record of previous non-disputed payments.

- Courier's GPS location proving delivery of the product.

Digital Goods:

- Confirmation email.

- Description of the digital goods and the date and time they were purchased and downloaded.

- Record of previous non-disputed payments.

- Evidence that the cardholder has accessed and successfully verified the profile or account before the transaction date.

- Cardholder's IP address and the geographical location of the device at the time of the transaction.

- Device ID and, if available, the name of the device.

- Cardholder's name and email address linked to customer profile or account.

Services:

- Documentation proving you provided the service to the cardholder (confirmation email, copy of invoice).

- Date the cardholder began use of the service.

- Evidence that cardholder used the service before.

- Record of previous non-disputed payments.

Once you have compiled all the documentation that proves your good faith and the tacit participation of the Cardholder, you must upload it to the evidence section:

Step 4 - Submit your defense

Then, you can submit the Defense: