Aim: To create payment methods that can therefore be accepted to sell your products.

Once created, payments methods must be kept associated to each specific point of sales supposed to use them.

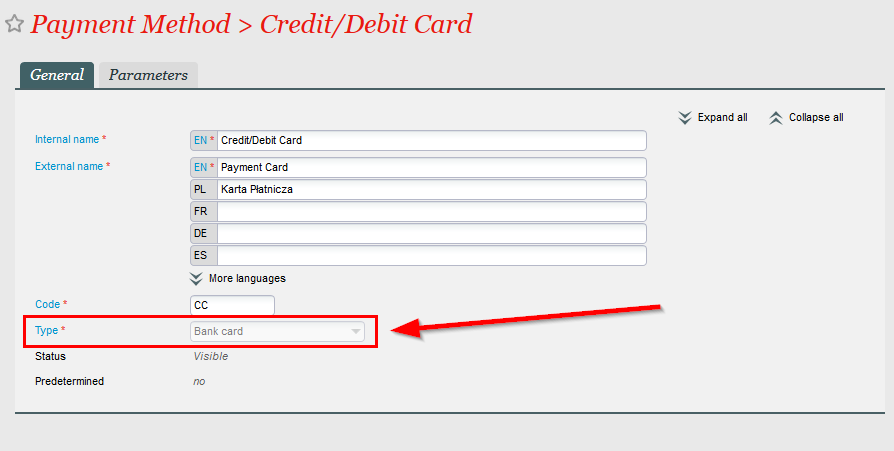

General

Beside a custom internal and external name, the most important parameter for a payment method is its type.

Each type allows specific functionalities.

Purpose | |

|---|---|

Cash | Cash |

Bank Card | For online credit/debit card payment and integrated box office terminals |

Voucher | If you sell gift vouchers, then these vouchers can be used as a payment method to pay for products. |

Credit note | Both possible for payment if customer has a positive balance and for refund if the organisation wants to refund on customer's Credit balance (for example temporarily before a manual bank transfer) |

External | For any payment method not integrated with SecuTix you want to use (ex.: credit card payment at box office if payment terminal is not connected to SecuTix) |

Pending Account | To use when the actual payment (financial flow) is deferred (example: invoice paid later by bank transfer). This payment method is mostly a temporary status until real payment is done by the customer. Pending account type allows to configure instalments. |

Credit Card with manual validation | Same as bank card, but with payment pending manual approval/refusal to be done by the organisation |

Check | Check |

Bank transfer | For automated SEPA payments (mostly for France) |

Parameters

Available for payment: possibility to use this payment method for payment

Available for reimbursement: possibility to use this payment method for refund

Cash return allowed: possibility to give back cash

Overpayment allowed: possibility to take amount higher than the cart amount

Split payment allowed: possibility to use in multiple payment at the box office

Holder currency allowed: possibiliy to take cash in other currency at the box office (different than multicurrency)

Provide order details: if on yes, SecuTix will send additional data about the order to the PSP. For example integrated with Klarna.

Product families: select product families for which this payment method can be used

Contact countries: select countries in which this payment method can be used (based on the main address of the buyer)

Minimum/maximum order amount: define thresholds above/below which the payment method can only be used

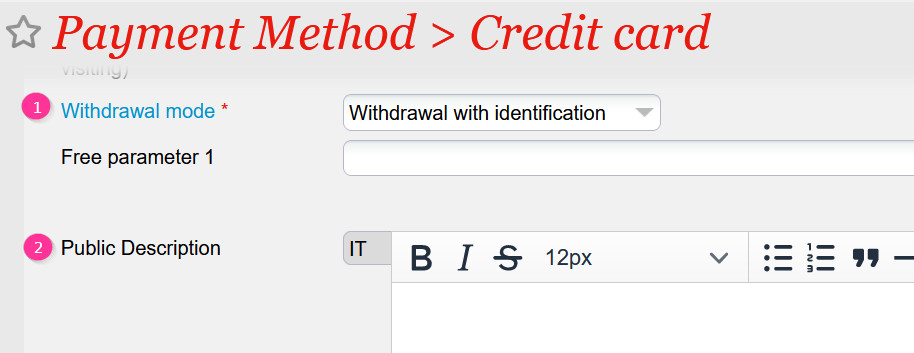

1 - Withdrawal mode

The mode chosen has an impact on the cashdesk closure for box office sales if cashdesk is managed in SecuTix.

- Not withdrawal: no receipt in the cash register (ex: pending account)

- Withdrawal by cash: for coins and notes (ex: cash)

- Withdrawal without identification: a receipt is in the cash register, but without idenfitication enabling to differentiate two payments of a same amount (ex: external payments, like credit card receipts resulting from not integrated TPEs)

- Withdrawal with identification: a receipt is in the cash register with idenfitication enabling to differentiate clearly payments (ex: credit card receipts resulting from integrated TPEs)

2 - Public descriptions

You have the possibility to add a description that will be displayed on the ticketshop

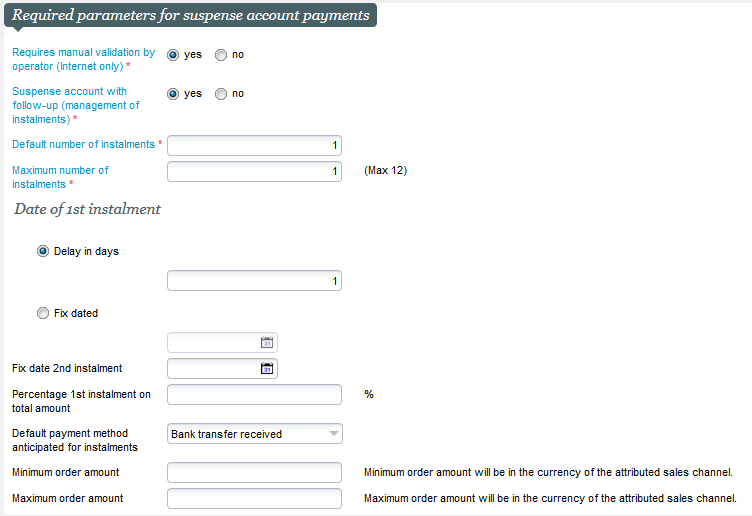

Specific options for Pending Account payment methods

Requires manual validation by operator (Internet only): if on Yes, a back office operator would have to validate the payment by pending account. Example: a customer pays by "bank transfer", then a BO operator needs to go in Sales | Payment screen, search for the payment, select it and click on Authorise or Refuse. After authorisation, the customer will be able to get the invoice to pay if on No, the customer will pay online with this pending account method and can receive immediately the invoice.

Suspense account with follow-up (management of instalments): "Yes" activates instalments. If "No", then a file paid with this payment method will be directly "Settled" even though payment is not actually received

Delay in days: default due date for the instalment (number of days after the order is done) for the 1st instalment

Fix dated: fixed default due date for the 1st instalment

inimum order amount will be in the currency of the attributed sales channel

aximum order amount will be in the currency of the attributed sales channel

Italian Certification | Specific behaviour

Italian clients using a Certified S-360 license cannot request installments payments.