Context

You are using price breakdown? The price breakdown is now taken into account when generating an invoice or other documents, thus providing accurate detailed VAT amounts and, if needed, more detailed product information. If you don't define price breakdowns for your price grids, you can ignore this feature as nothing changes in your case.

Solution

Several improvements have been brought to the invoices and other order or file related documents. Following documents benefit from these improvements:

- File summary

- Order summary

- Invoice

- Order receipt

Take into account the price breakdown to compute the VAT amounts

This feature takes into account the VAT rates of each price component used in the price breakdown. This allows a more accurate computation of the VAT amounts if the different price components have different VAT rates. This new computation concerns the VAT amount and without VAT price displayed for a given product as well as the VAT breakdown provided at the bottom of the document. Before this feature, only the VAT rate of the product was taken into account.

Important information

You must set-up the correct VAT rate for all your price components. Otherwise, wrong VAT amounts and wrong without VAT prices will be displayed on your invoices and documents.

Display the price component detail

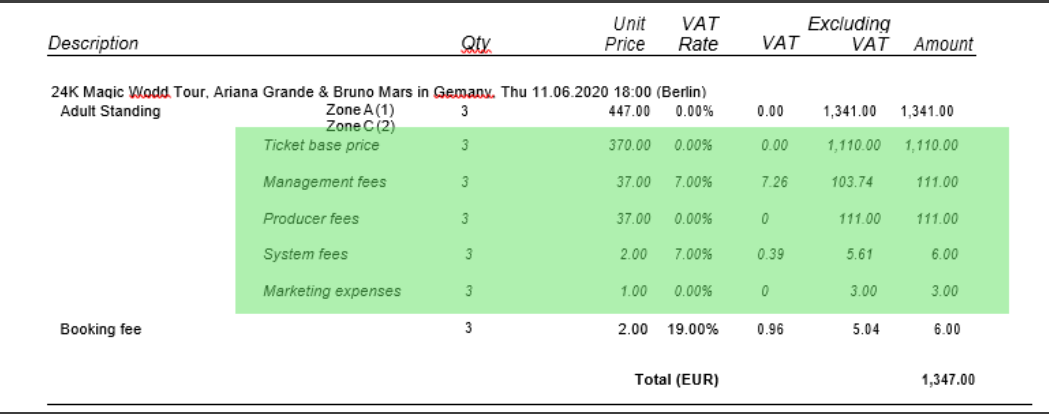

A new document parameter allows you to display the price component detail for each product for which a price breakdown has been defined. If this parameter is set, the document will display, in addition to the already existing product description, one line for each price component used in the price breakdown. The price component detail line will display the price component name and the amounts (with and without VAT).

Highlight

An order may still contain a combination of products with and without price breakdown.If no price breakdown has been defined for a product and the parameter to display the detail has been set, simply no price component detail will be displayed.

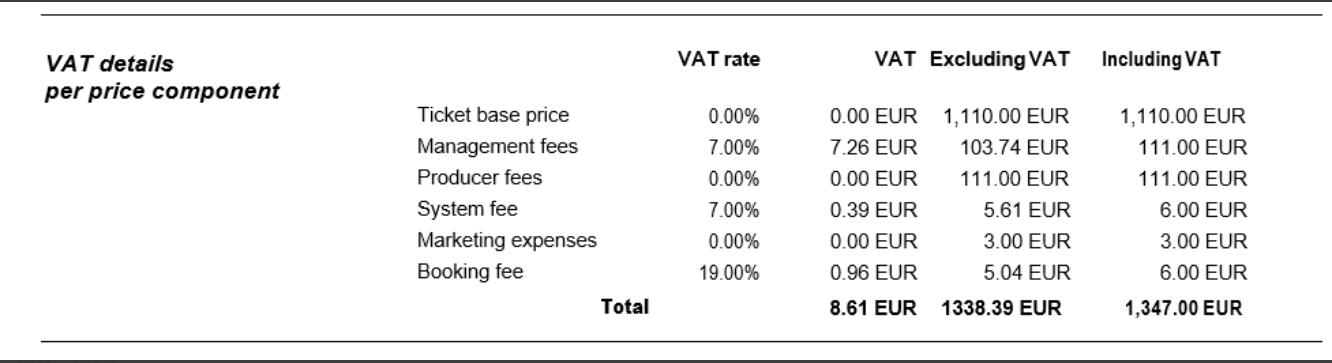

Display the VAT breakdown per price component

By default, the VAT breakdown contains one line per VAT rate. A new document parameter allows you to get a more detailed breakdown containing one line per price component. Fees (shipment fees, payment fees, etc.) will also be displayed on separate lines.

Highlight

An order may still contain a combination of products with and without price breakdown. The VAT breakdown will contain one line for each product for which no breakdown is available. This line will display the product name.

Getting started

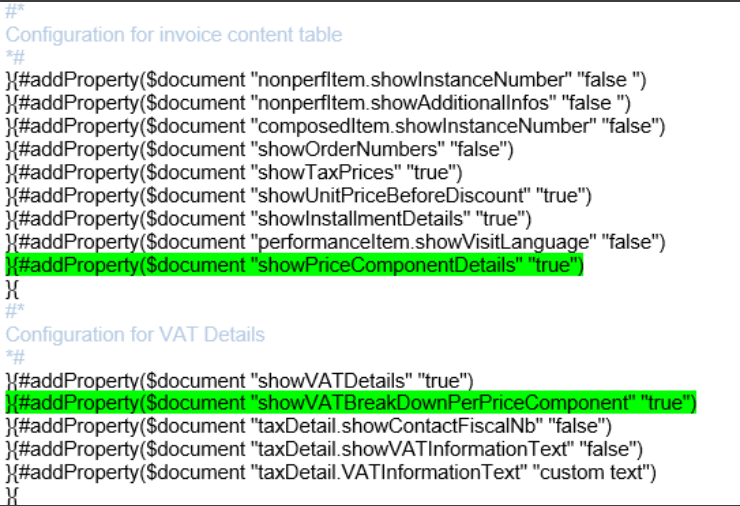

You don't have to do anything to benefit from the new computation of the VAT amounts. The price component detail and the VAT breakdown per price component may be enabled by adding the document properties (to the document template) highlighted in green on the image below.

Examples

- Price component detail on an invoice

- VAT breakdown per price component on an invoice