Prerequisite: find an insurance company

Before offering this service, you must enter into an agreement with an insurance company. The insurer will compensate the end customers.

A new custom report has been developed and allows you to send to your insurer the details of all the people who have taken out cancellation insurance and the products on which they have taken it out.

Warning: your operators should never issue compensation on an order containing a cancellation insurance - this would be a double payment, since in principle it is the insurance company that deals with refunding the money. A warning message was placed in the window to keep operators aware of this.

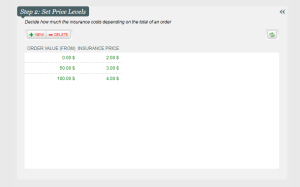

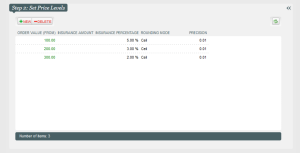

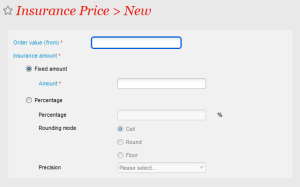

Warning: Your operators should never set-up a price level (see below) with an order amount of zero. Indeed, you aren't allowed to sell a cancellation insurance for a free order since the insurance will never pay anything.

Configuration in just four steps

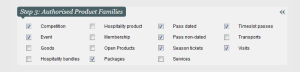

In the SecuTix configuration, go into the organisation context, and go to the cancellation insurance, which is at the same location as Advantages and Cross selling:

Catalog > Miscellaneous > Cancellation Insurance