| Excerpt |

|---|

A new way of processing direct debit payments for the SEPA area is now available. Direct debit payments have been available for a few years based on the services provided by our Slimpay partner. You can now use a new in-house process to handle direct debit, allowing you to process direct debits on the basis of standardized bank files that you can import/export from SecuTix. |

The new payment method is also based on the pending account, meaning that the tickets may be printed before they are paid. The main difference between both methods resides in the mandate creation in case of online sales. Slimpay provides an automatic mandate creation while, with this new payment method, mandates are created outside of SecuTix (see section Solution below for more details).

Solution

Comparison of the different direct debit payment methods

The table below compares the three available direct debit payment methods:

- Bank withdrawal: the first direct debit payment method provided by SecuTix

- Slimpay direct debit: the direct debit payment method based on pending account and using Slimpay (for bank file generation and automatic mandate creation for on-line sales)

- SEPA direct debit: the new direct debit bank payment method also based on pending account

| Bank withdrawal | Slimpay direct debit | SEPA direct debit | |

|---|---|---|---|

| Installments dates | Installment must take place before the dated products it contains | No restriction | No restriction |

| Installments amounts | Amount matches the price of the included products (each installment has its own amount) | All installments have the same amount. You may define a different amount for the first one. | All installments have the same amount. You may define a different amount for the first one. |

| Tickets available before payment | No | Yes | Yes |

| Payment method available on box office | Yes | Yes | Yes |

| Payment method available on Ticket Shop | No | Yes | Yes |

| Mandate required to process payment | Yes | Yes | No |

| Mandate management from box office | Manual management | Manual management | Manual management or no management |

| Mandate management from Ticket Shop | N/A | Internet user is redirected on Slimpay page that will trigger an automatic mandate generation | Internet user enters the bank information and checks a box to give his consent for direct debit. If needed, the actual mandate must be handled outside of SecuTix. |

| Generation of bank payment file to be provided to the bank | Yes (triggered manually from a screen) | Yes (manual or automatic batch schedule) | Yes (manual or automatic batch schedule) |

| Import of payment status file provided by the bank | No. A screen allows the operator to mark each payment as succeeded or failed | Yes. The feature imports the SEPA file pain.002 that describes the failed payments only. Payments without bank feedback are considered successful 5 days after its due date. | Yes. The feature imports the camt.053 or camt.054 file belonging to the ISO20022 standard. These files contains the successful payments, not the failed ones. |

| Payment method available for EUR | Yes | Yes | Yes |

| Payment method available for £ | No | Yes | No |

| Payment method available for CHF | No | No | No but feasible since the ISO20022 standard is also used for bank transfers in CHF (would need some development) |

| Reconciliation screen comparing payment status between SecuTix and external system | No | Yes | No |

| Info | ||

|---|---|---|

| ||

SEPA allows to withdraw money from a bank account with or without a mandate. In absence of a mandate, the debtor will be allowed to refuse this bank withdrawal more easily and during a longer period of time. Concretely, you may have to credit a bank account several months after having performed a debit on it. As a result, establishing a signed mandate before the first bank withdrawal is a matter of financial risk, not a technical matter of failed or succeeded payments. |

Which direct debit payment method should I use?

- If you want to be sure that tickets are paid before the corresponding event or visit, use the bank withdrawal payment method.

- If you want an automated mandate generation during on-line sales, use the direct debit payment method based on our Slimpay partner.

- If you want a flexible and easy to use solution, however providing a lower level of "built-in" security, use the new direct debit payment method described in the next sections.

Use of the new payment method

Scope

The new payment method is available for the following cases

- Sales on box office

- Sales on Ticket Shop (without automated on-line mandate generation)

- Membership renewal

- Season ticket renewal

Transfer of season ticket holdersStatus colour Blue title UPCOMING

Sales on box office

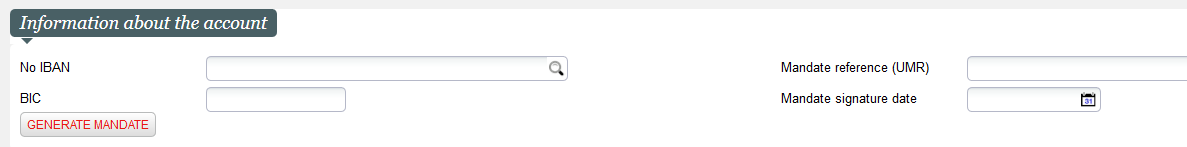

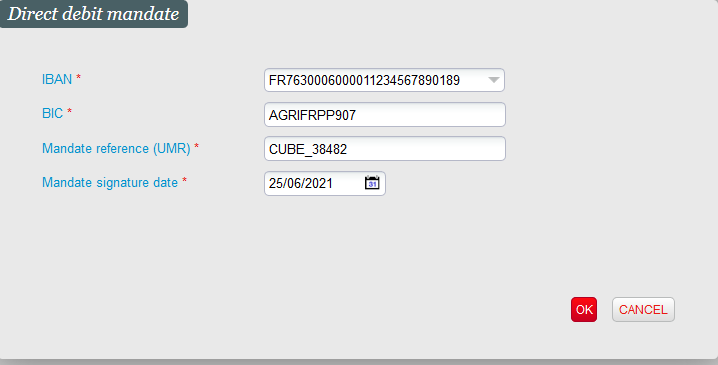

The operator first enters the mandate information from the contact detail screen (tab Management)

If the end customer has signed a mandate, the operator may enter the mandate reference and mandate signature date. Otherwise, the operator may click on the Generate mandate button. The system will then generate a mandate reference (based on the contact number) and consider it as valid from today.

The operator can revoke the consent by removing the mandate reference.

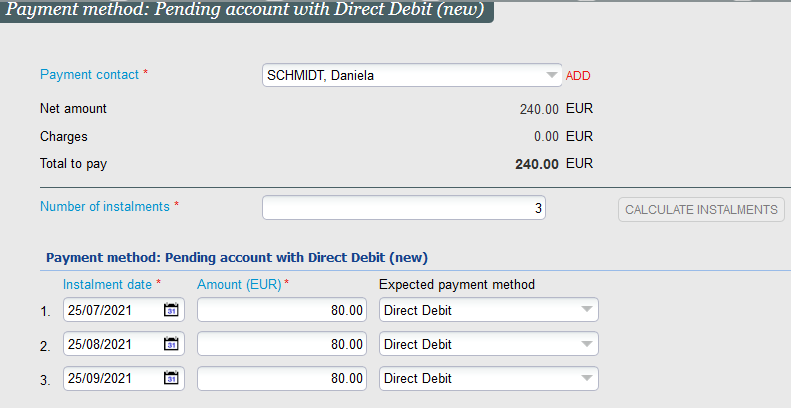

The operator chooses the created payment method (see Getting started section)

As for any installment based payment method, he may choose the number of installments within the configured range. He may then modify the mandate information if needed:

If the operator modifies the mandate information, a message will inform him that the mandate information stored at contact level will be updated accordingly.

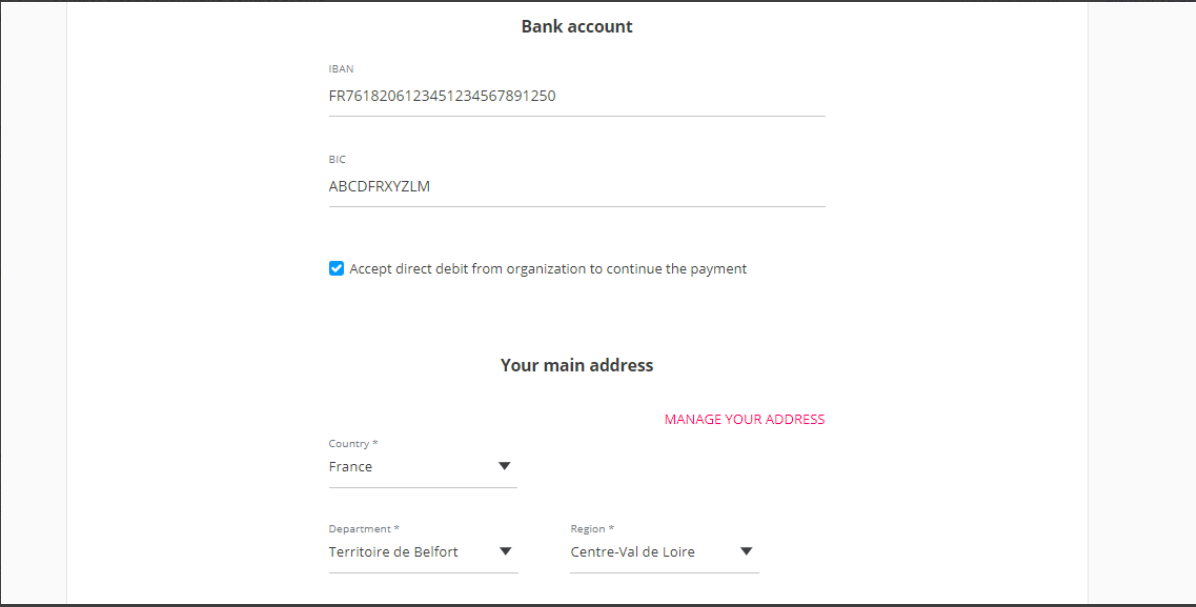

Sales on Ticket Shop

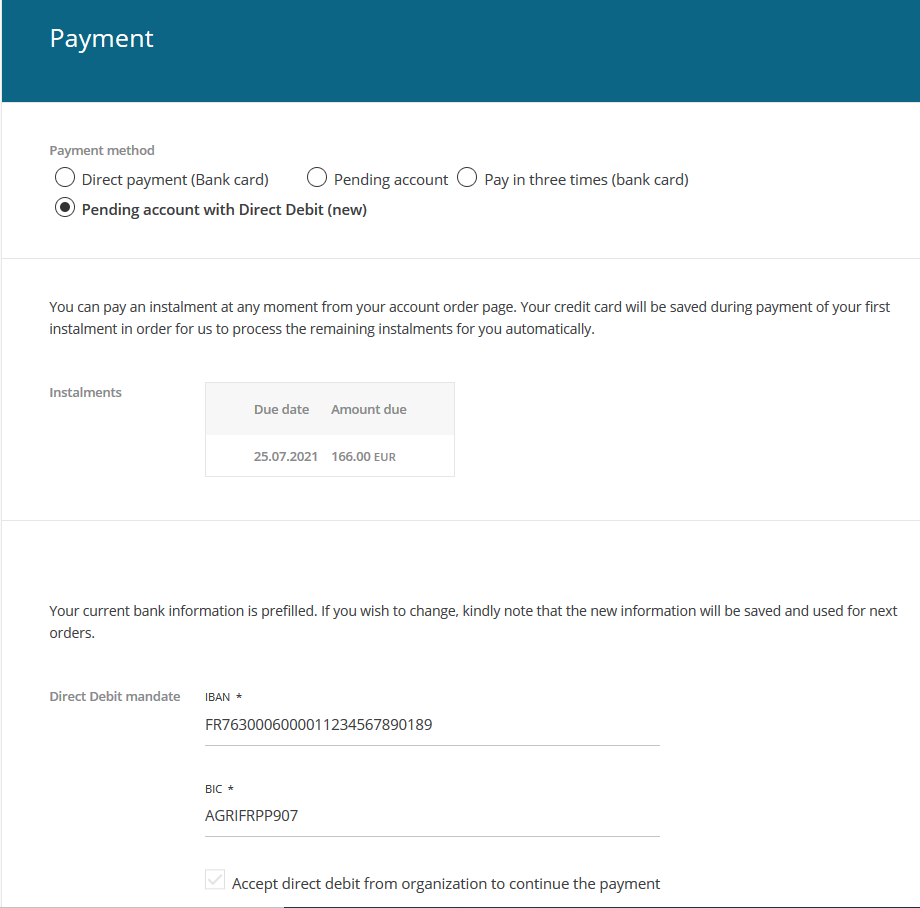

When the internet user chooses the new direct debit payment method, the Ticket Shop displays the installments and the bank account information.

If the internet user has already given his consent, the check-box concerning the consent is checked and cannot be modified at this step (see below how to revoke the consent). However, the internet user may modify the bank account information.

The internet user may revoke or add his consent from profile page:

| Warning | ||

|---|---|---|

| ||

You should not allow your internet users to revoke or enable consents on the Ticket Shop if you are managing signed mandates. Indeed, the internet user may modify the mandate reference entered by the box office operator (by removing it and replacing it by the automatically generated mandate reference). Such inconsistencies should be avoided. The Getting started section describes how to enable or disable this possibility. |

Membership renewal

| Status | ||||||

|---|---|---|---|---|---|---|

|

- The memberships paid by direct debit will be renewed by direct debit

- The renewal function will reuse the number of installments that were used to pay the initial membership

- The due dates and installment amounts are computed based on the current definition of the payment method (and, of course, the price of the new membership)

- The system will create a reservation (instead of a sales order) if the direct debit method can't be used for some reason, for example:

- The end user has revoked his consent (no mandate reference and signature date are available anymore in SecuTix)

- The current definition of the payment method doesn't allow the payment, for example:

- The maximum number of installments has been lowered from 3 to 2 and the initial membership was paid in 3 installments

- The minimum amount accepted for this payment method has been increased from 50€ to 100€ and the price of the new membership is 80€

Season ticket renewal

| Status | ||||||

|---|---|---|---|---|---|---|

|

- The renewal function tries only to create a payment (whatever the payment method) if the automatic renewal flag is set. If the flag isn't set, it will only create reservations.

- If the automatic renewal flag is set but a given end customer has requested to stop the renewal (criterion STOP_AUTOMATIC_ST_RENEWAL is set to yes), the renewal function won't create any order for this contact.

Transfer of season ticket holders

| Status | ||||

|---|---|---|---|---|

|

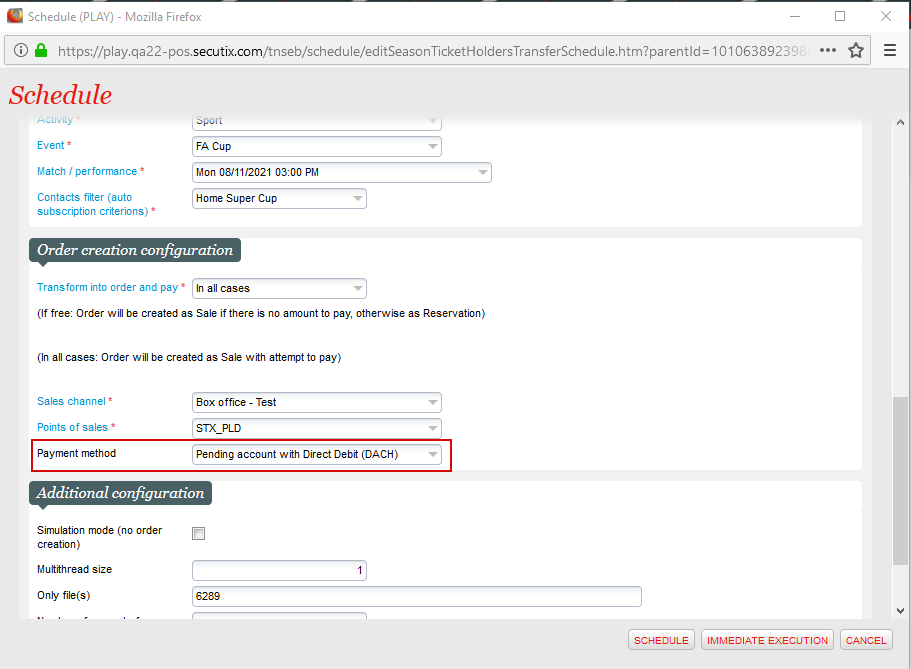

Function Transform reservation to sale

The operator can select the payment method to be used to pay the reservations. The payment method may be of type bank card or (this) direct debit.

- If the operator selects a bank card payment method, the system takes this payment method to process the payment. No payment will be created if the bank card payment fails (for example, no alias is available)

- If the operator selects the direct debit payment method and the end customer has provided the bank information and signed a mandate, the reservation will be paid by direct debit using the settings of the payment method (default number of installments, delay before first installment,...). If the bank or mandate information aren't available, a message will be provided in the execution log and the reservation is skipped

- If no payment method is selected, the first bank card payment method allowed on the point of sales defined in the batch parameters will be used. If the end customer doesn't have an alias, a message is logged and the reservation is skipped

Function Transfer of season ticket owners

The operator has also the choice between bank card and direct debit payment method. The behaviour is similar to the function Transform reservation to sale. The only difference is the behaviour if the payment failed. In the case of Transfer of season ticket owners, the behaviour is defined by the (already existing) parameter Transform into reservation if a payment error occurs.

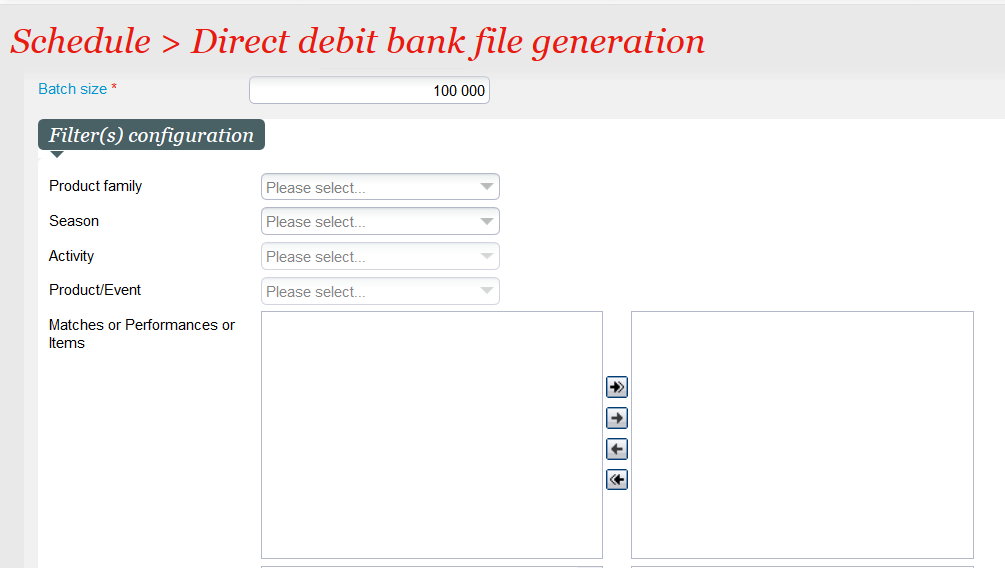

Send the payment file to the bank

- The payment file is generated by the function Direct debit bank file generation of the batch of type Instalment management (see getting started section below for more information on how to set-up the batch).

- You may select the product for which you want to send the installments by filling the corresponding parameters of the function schedule:

The function will send the installments of the orders containing the selected product or performance(s). Note that the installments of orders containing additional products will also be exported.

- The file is available on the specified FTP server (URL defined at batch level)

- If no FTP server has been specified or the file couldn't be stored on the FTP server, the file can be downloaded by clicking on the link displayed in the execution log (archive).

Import the payment status file from the bank

- The function Confirm debit bank file of the batch of type Instalment management allows to import the payment status file either automatically from a FTP server or by uploading it manually (see getting started section below for more information on how to set-up the batch).

Manual management of the installments

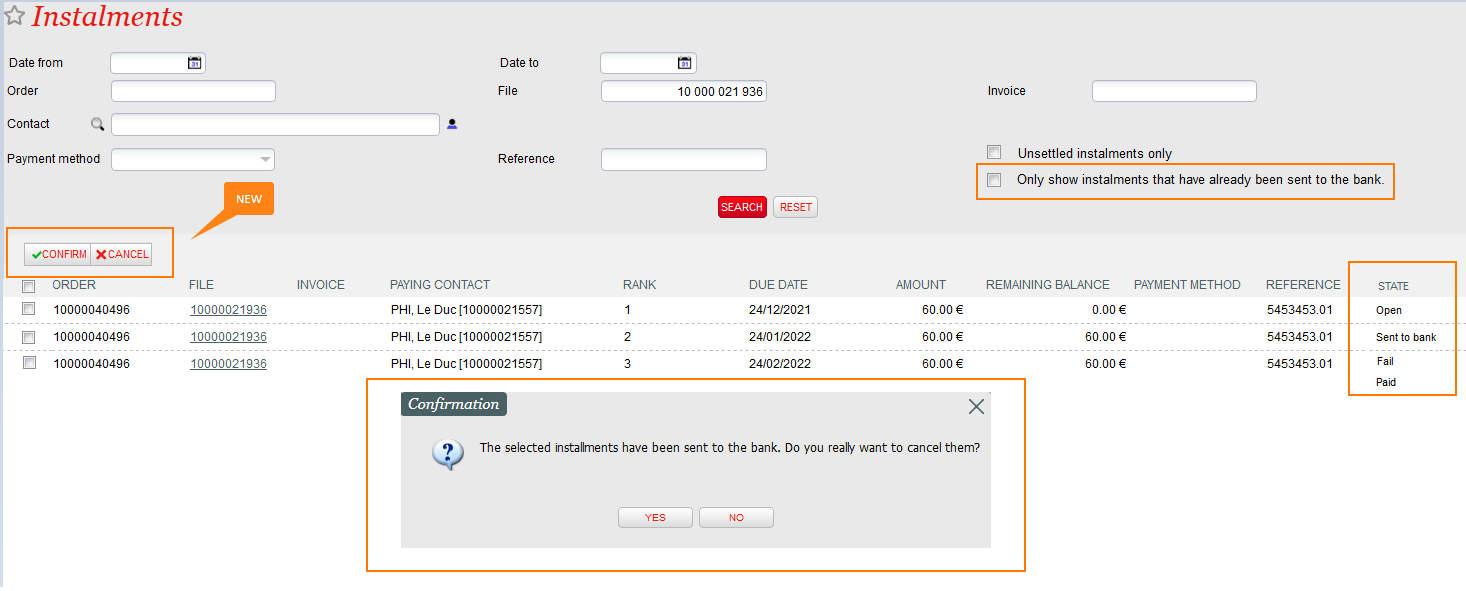

Display and manage the state of the installments

As for all SecuTix payment methods based on installments (methods of type pending account with follow-up), the operator may view the installments in the installments menu of the sales context. The installments screen has been extended to allow some manual operations on the installments. More precisely:

- A state column has been added to the list to provide you the state of the installment:

- Open: the installment has been created during the closure of the order but hasn't been sent yet to the bank (nor marked manually as paid or failed)

- Sent to bank: the installments has been sent to the bank but the bank hasn't sent the status of this payment yet

- Fail: the installment has been marked manually as failed (the bank provides only the list of successful payments)

- Paid: the installment has been paid (either the bank has sent this information or an operator has marked the installment manually)

- A new filter allows to show only the installments that have already been sent to the bank

- The operator may select multiple installments already sent to the bank and confirm or cancel them. More precisely:

- Confirming an installment means confirming that it has been paid. This feature is mainly used when no payment status file is imported from the bank

- Cancelling an installment means that the payment of the installment has failed or must not be performed. You could use this option in following cases:

- You have sent the installment to the bank a long time ago (without receiving any payment confirmation) and you don't expect a successful payment anymore

- You have generated the file but haven't sent it yet to the bank because the end customer wants to use another payment method. The cancel button will then cancel the fact that you have generated the file and let your customer select another payment method.

Track the installments

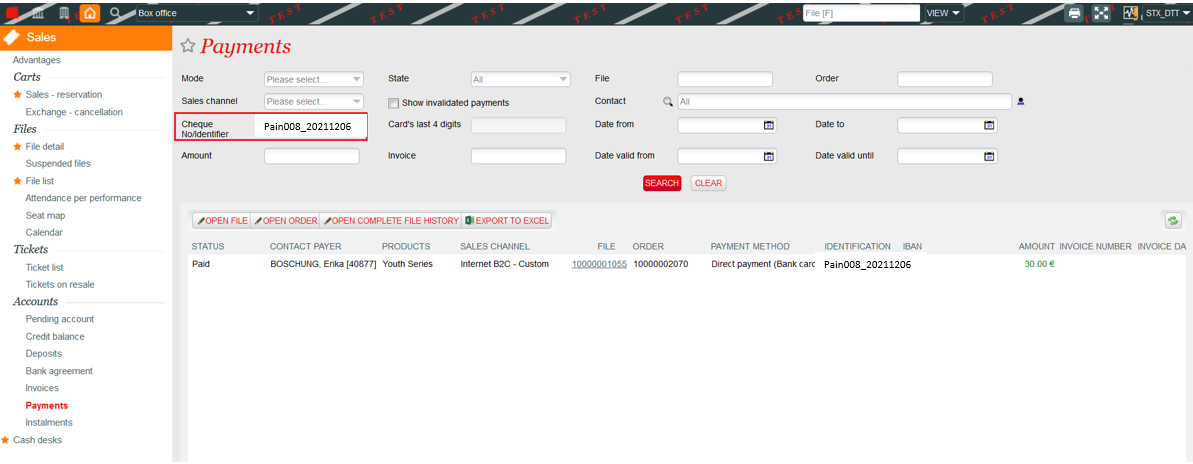

During the generation of the direct debit bank file, the name of the file generated is stored in the identifier field of the generated payments. As a result, you can:

- Search for all the payments included in a given bank file

- Display in which bank file a given payment has been generated (for example: a given file hasn't been balanced for a long time and you want to check if something went wrong in the direct debit process)

Direct debits and refunds

Once an installment has been sent to the bank, any subsequent order cancellation (entire order or a part of it) cannot cancel the concerned installment. More generally, in case of partial order cancellation, SecuTix will cancel the installments not sent yet to the bank and with the most distant deadline.

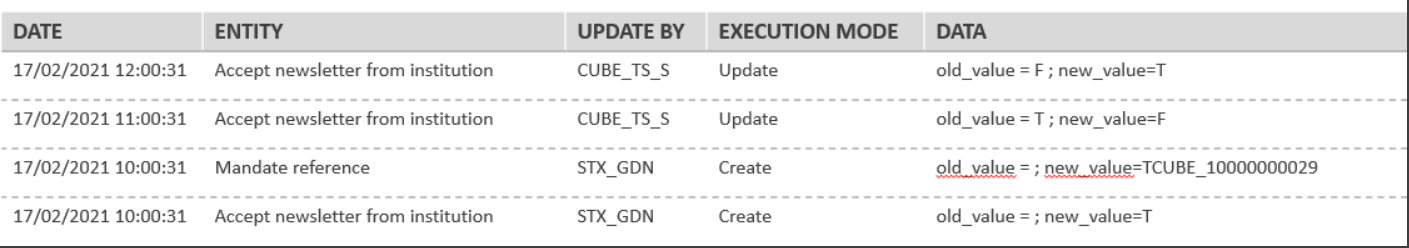

Storage of end customer's consent

If you don't manage mandates signed by your end customers (either manually or through Slimpay), the end user just has to click on a check box in order to accept direct debit. You can view the history of customer's consent in the new screen Audit contact available from the contact detail screen.

This screen also shows marketing and communication consents provided by the end customer.

Payment information to end user

| Status | ||||

|---|---|---|---|---|

|

- The payment purpose is based on the first product of the order related to the installment (that hasn't been refunded in the meantime)

- If the product is a competition , the payment purpose will contain the competition name, the opponent team and the match date-time

- If the product is an event, the payment purpose will contain the event name and the performance date-time

- For any other product (including composed products), the payment purpose will contain the product name

- Note that the payment purpose will be truncated if it exceeds the maximum length of 140 characters allowed by the SEPA standard. In that case, the competition name and event name will be removed first.

Getting started

Set-up the payment methods

You have first to create a payment method of type direct debit. This payment method will be used when performing the actual direct debit.

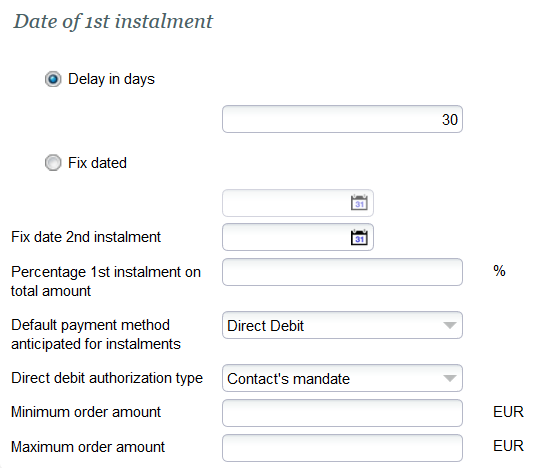

You have to define a payment method of type pending account with follow-up. This payment method will be used when creating the sales order.

Make sure to select Contact's mandate as the direct debit authorization type. This means that the bank information (IBAN, BIC. etc..) have to be entered in SecuTix since they aren't managed by an external system (like Slimpay).

All other parameters used to configure the installment creation process (number of installments, dates, amount) are identical to the other pending account based payment methods provided in SecuTix.

Allow the usage of the payment methods

- The pending account payment method must be authorised for the concerned point of sales

- The contact must be authorised to use a pending account payment method and the maximum balance of the pending account must not be reached

Allow (or not) the internet user to grant or revoke a payment mandate from his user account

In the menu Institution > Organisation > Screen configuration, configure the field bank_AcceptDDebitFromOrg to be displayed (or not) in screens B2C_INTERNET_CONTACT_FORM and B2B_INTERNET_CONTACT_FORM.

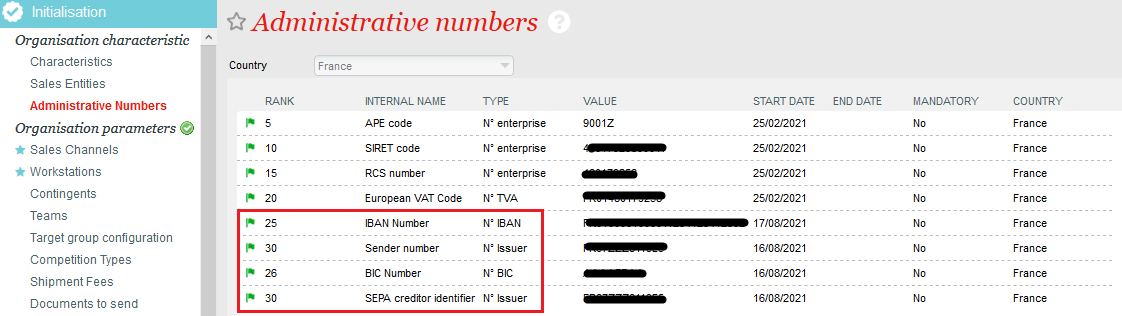

Set-up of administrative numbers

In order to generate the installment files, Secutix needs the following 4 administrative numbers :

If you don't see them, you'll have to ask for them to be activated in the DB.

As described in more detail below, you may override the IBAN and BIC numbers in the batch parameters.

Set-up the batch to generate the payment file

- Create a batch of type Instalment management if it doesn't exist yet.

- Schedule the function Direct debit bank file generation.

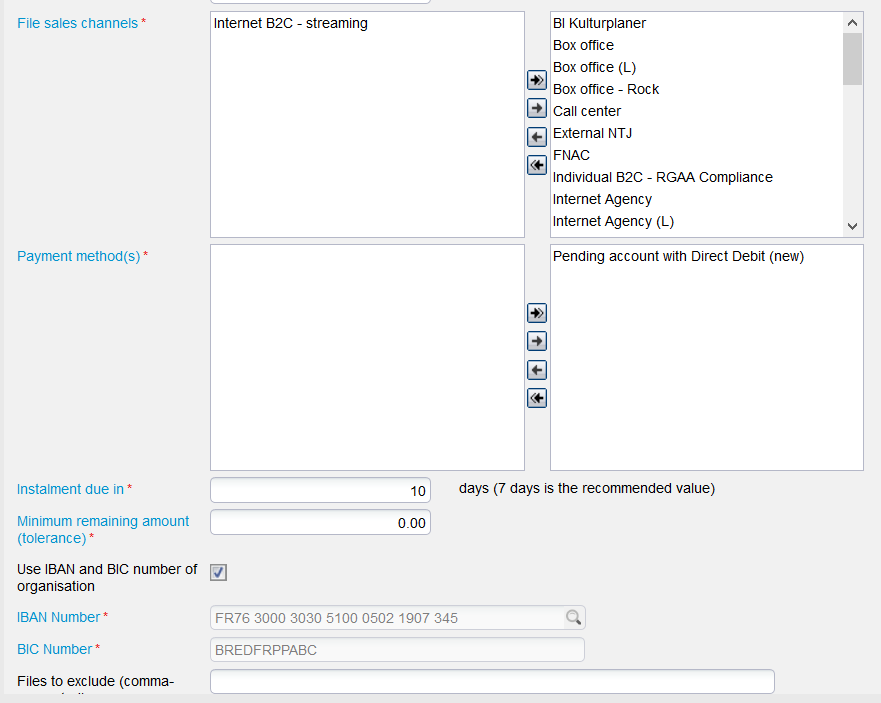

- The main batch parameters are described below:

- File sales channels: consider the files created on the selected sales channels

- Payment method(s): consider only the installments belonging to orders paid by one of the specified pending account payment methods

- Instalment due in:consider only installments due in the next N days (example: current date is 01.07.2021. If the parameter equals to 10, all the installments still not processed and which deadline is the 11.07.2021 or before will be taken into account)

- Minimum remaining amount: Ignore installments which amount (that remains to pay) is less than the entered amount

- IBAN: You may either use the organisation's IBAN or another IBAN defined in the batch parameters. This allows you to use several bank accounts to gather the money debited from the end customer's account, for example, depending on the sales channel or the product family.

Set-up the batch to Import the payment status file

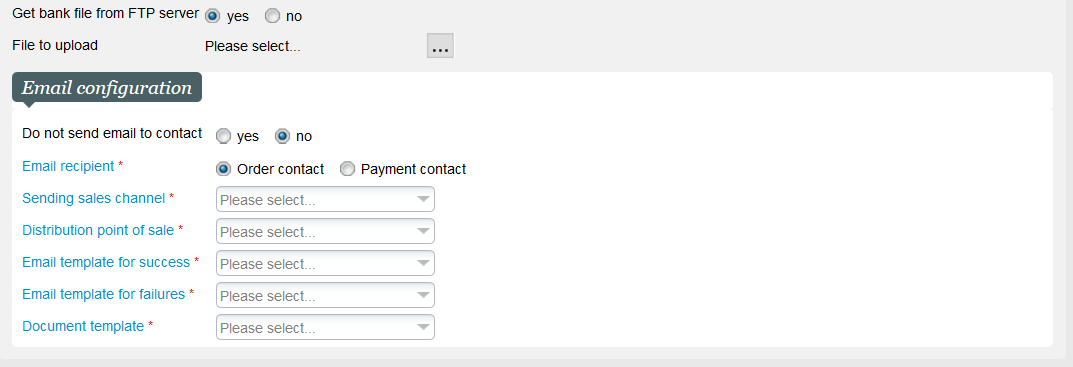

- Schedule the function Confirm debit bank file of batch Instalment management.

- The main batch parameters are described below:

- Bank file: you can either let the import function get the file from the FTP server (which URL is defined at batch level) or upload it manually

- Email configuration: you can decide to send an email (or not) to the end customer in order to inform him about the performed direct debit (click No to send an email). If you decide to send an email, following information must be provided:

- The email may be sent to the purchase contact or payment contact

- The email's origin (i.e. the sales channel and point of sales from which the email is sent).

- The email's template in case of success. It must be a document type of document class instalment payment success email

- The email's template in case of failure. It must be a document type of document class instalment payment failure email. Note that the current bank file won't provide any information about failed payments. However, this parameter has already been foreseen in case of future ease.

- The document template. It's a document type belonging to document class file recap (file summary)

| Info | ||

|---|---|---|

| ||

By default, the internet users or operators have to enter the BIC code of the end customer's bank account. You can request a SecuTix service to make the BIC optional for a list of countries. For example, you can decide that end customer residing in the same country as your institution don't have to enter the BIC code but still require the BIC for end customers living abroad. The service team will store the codes of the countries with optional BIC in the institution parameter Sepa optional BIC. |