Thanks to the new partnership with Ingenico Payment Services (Ogone) payment service provider, you will benefit from more advantageous rates per transaction, while offering new payment facilities to your internet users.

| Warning | ||

|---|---|---|

| ||

To begin this procedure, don't hesitate to contact us. |

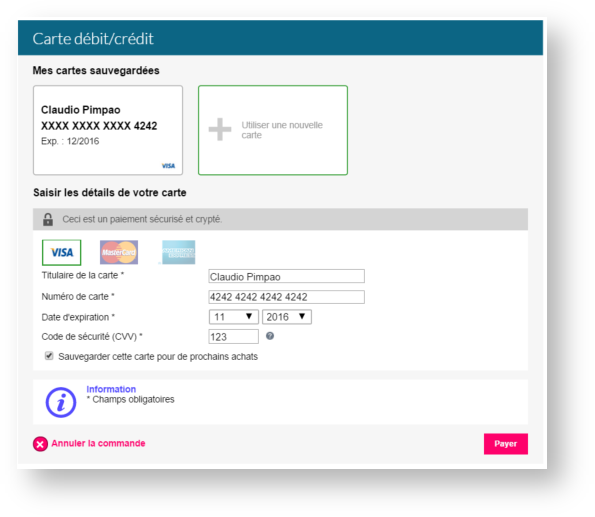

Saving of credit/debit cards

A user can now save his credit/debit in order to facilitate his future payments. He just has to select the "Sauvegarder cette carte pour de prochains achats" checkbox.

Once the card is saved, the user will be able to select it easily during a future purchase. Of course, for security reasons, the system will request the user to enter his CVV.

| Info | ||

|---|---|---|

| ||

You can control the security policy applied during payments (CVV request, activation of saving, etc.). |

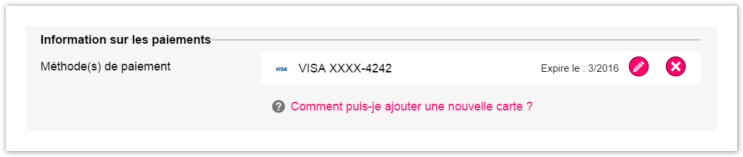

Finally, the user can manage his cards from his client account. He can modify the date and the name of a card, or even delete the previously saved card.

Easy entry on mobile

The payment becomes a child's play on mobile! In fact, the selection of a saved card and the scan of a new credit card via the camera enable to pay in no time.

Pay by selecting a saved card

ORScannez une nouvelle carte

Scan a new card

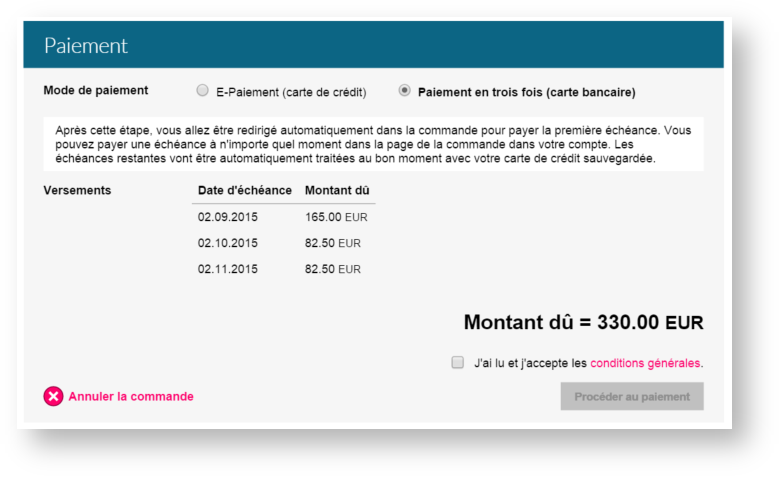

Three times payment

To facilitate the payment of huge amount of money, you can offer multiple payments to your clients. Set the number of due dates, the breakdown of amounts, a minimum amount and your client will be offered payment over a number of months. Of course, this mode of payment will not be available if the date of an article of the basket is before the last due date.

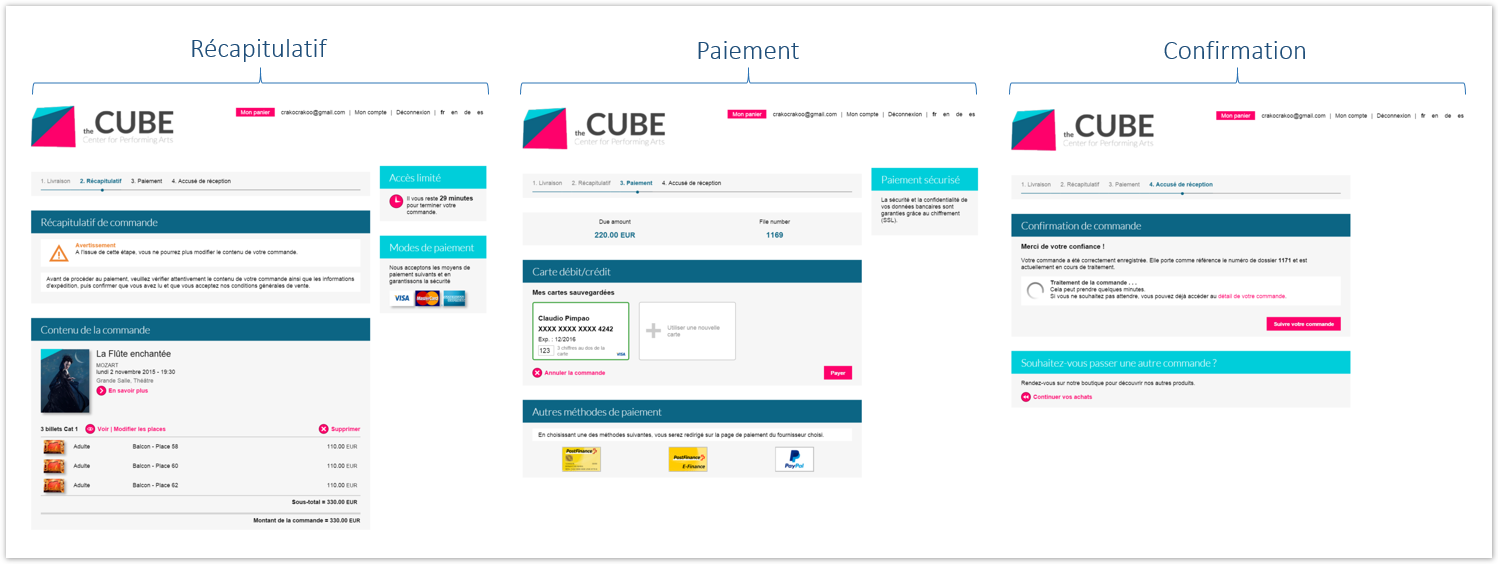

New payment page

Until now, the payment page was hosted and offered to clients through the payment service provider. The visual style and ergonomics were not in line with the rest of the online sales website. To solve this problem, we offer a brand new payment page which is simple, elegant and directly integrated in our system. For users, the payment becomes an integral part of the online purchase process.

| Info | ||

|---|---|---|

| ||

During a payment by credit card, you can set your risk management policy. In fact, to avoid disputes, you can finely activate control by 3D secure (for all payments, never or only if the payment is close to the date of the event). |

Reimbursement on credit card

In the case of reimbursement, you can decide to credit the amount directly in the credit/debit card used during payment

Paiement en trois fois

Pour faciliter les paiements de grandes sommes d'argent, vous êtes en mesure de proposer le paiement multiple à vos clients. Paramétrez le nombre d'échéances, la répartition des montants, une somme minimale et votre client se verra proposer un paiement échelonné sur plusieurs mois. Bien entendu, ce mode de règlement ne sera pas disponible si la date d'un article du panier se situe avant le paiement de la dernière échéance.

Nouvelle page de paiement

Jusqu’à présent, la page de paiement était hébergée et servie aux clients par le prestataire de paiement. Le style visuel et l’ergonomie n’étaient pas en accord avec le reste du site de vente en ligne. Pour régler ce problème, nous vous proposons une toute nouvelle page de paiement simple, élégante et directement intégrée à notre système. Aux yeux des utilisateurs, le paiement devient partie intégrante du processus d'achat en ligne.

| Info | ||

|---|---|---|

| ||

Lors d'un paiement par carte de crédit, vous pouvez paramétrer votre politique de gestion du risque. En effet, pour éviter les litiges, vous êtes en mesure d’activer le contrôle par 3D secure de manière fine (pour tous les paiements, jamais ou seulement si le paiement est proche de la date de l’événement). |

Remboursement sur carte

Dans le cas d’un remboursement, vous pouvez choisir de créditer le montant directement sur la carte de crédit/débit utilisée lors du paiement.